The Tricky Trend That’s Blurring Budget Transparency

State and local budgets are based on general fund revenues. The cash usually comes from such primary sources as income and sales taxes, and pays for a wide swath of government services. When managers talk about “balancing the budget,” they’re almost always referring to balancing the spending and revenues from this repository.

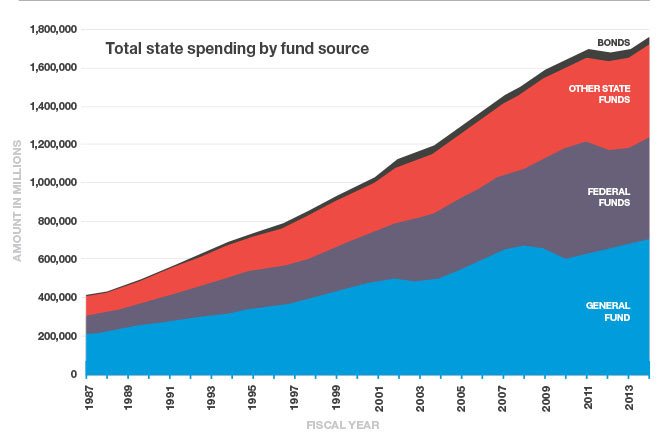

Reliance on the general fund as the centerpiece of fiscal management, however, has growing flaws. This is largely because the general fund is diminishing as the main source of money for governments. Data from the National Association of State Budget Officers shows a fairly steady drop in the portion the general fund makes up of the total -- 41 percent in 2014 compared with 52 percent in the early 1990s. In Virginia, the general fund made up 47 percent of the total in 2006 and only 39 percent in 2015.

Some of the drop comes from an increase in bonds and, even more so, federal funds, but there’s also been a slow and steady rise in the size and quantity of special funds that are earmarked for specific purposes and get little attention in the annual budget debate.

The Fiscal Futures Project at the University of Illinois at Chicago (UIC) has pinpointed a number of problems with this shift. Depending on state law, special funds may bypass the appropriations process, and unlike the general fund, money collected and unspent may be retained at year’s end rather than being returned to the general coffers. This makes special funds an appealing target when tough budget times hit. Lawmakers see these plush balances outside the general fund as a means to balance the budget. They may transfer or lend money from the special funds to the general fund.

That leads to additional problems. It is a common tenet of responsible budget management that one-time money be used for one-time expenditures. If these funds are raided, then unless revenues are raised or expenses are cut, the government will still come up short in the next budget cycle.

The movement of money between general and special funds “has reduced the transparency of budgeting,” says David Merriman, a professor at the Institute of Government and Public Affairs at UIC. The cloudiness of the budget picture enables political leaders to boast about a reduction of general fund spending, when spending has just been added to one or more special funds.

States can also put themselves in legal peril by using funds for general purposes that are restricted to a specific use. Just after the recession ended, for example, the Wisconsin Supreme Court nixed the transfer of money from a malpractice fund into the state’s general fund. The state had to pay back the $200 million along with interest.

New Mexico’s reliance on special funds has led to a host of policy and management problems. As the state auditor pointed out in a February analysis of fund balances, New Mexico had $4.4 billion in unused balances socked away outside of the general fund at the end of fiscal year 2015. Some of that money is untouchable because of iron-clad restrictions about its use.

The large amounts of unspent money raise questions about whether so much should be in funds that get so little attention. Auditors in New Mexico, for instance, found that a significant amount of money was being retained in revolving funds, which are intended as a cash-flow device for agencies and local governments. Localities are supposed to use this money and then return it so it can be used again. The practice isn’t the problem, but the auditor found that some of the funds had very little lending activity, even though the state faces critical infrastructure needs for which it could be used. For example, $34 million sat unused in a revolving fund account for rural infrastructure between fiscal years 2014 and 2015. “You can’t justify a loan fund that had no loans out of it,” says Tim Keller, New Mexico’s state auditor.

Keller, who was a legislator for six years before he took over last year as state auditor, spells out the real-life drawbacks of low-attention money. As a member of the legislature, he helped secure financing to build a dam in Las Vegas, N.M. “I thought that fixing the dam was important and I put my political weight behind it,” he says. He wasn’t alone. The governor and local legislators “were all taking credit for the dam,” he says.

But that back-patting was premature. With less visibility, money outside the general fund can go unspent, particularly when a legislative appropriation only provides partial funding as was the case for the dam. That’s because “there’s no one constantly monitoring it,” says Sarita Nair, general counsel in the auditor’s office.

Today, the dam is half finished, the money that was appropriated is largely unspent, the project’s opponents have brought a lawsuit to stop its progress and the town still has a water crisis. “You can take credit for funding something, but that’s a different question than actually having it built,” Keller says.

(Source: National Association of State Budget Officers)