Rainy Day Fund Strategies - A Call to Action

Executive Summary

Totaling $62.4 billion in 2019,1 rainy day funds are the savings accounts of US states. They are vital fiscal tools that help governments cope with natural disasters and can help them avoid crushing spending cuts when economies falter and revenues nosedive. In this working paper, the Volcker Alliance examines the reserve fund policies and practices of all fifty states, based on the findings and data underlying our 2017 and 2018 Truth and Integrity in State Budgeting reports. This paper builds on the Alliance’s grading of state reserve funds and identifying of best practices (both contained in the reports), and subsequent research. It discusses why rainy day funds are crucial and offers states detailed guidelines to bolster their policies for withdrawals and replenishments, and for linking reserves and revenue volatility.

We also offer ten rainy day fund policy improvements that states can adopt to better protect themselves against economic, fiscal, and natural disasters.

Introduction

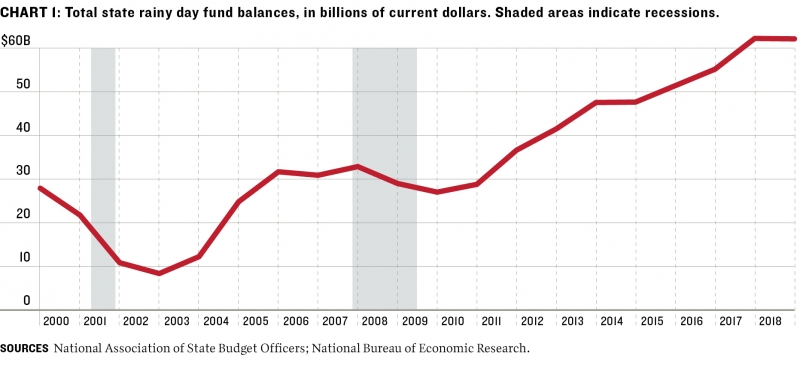

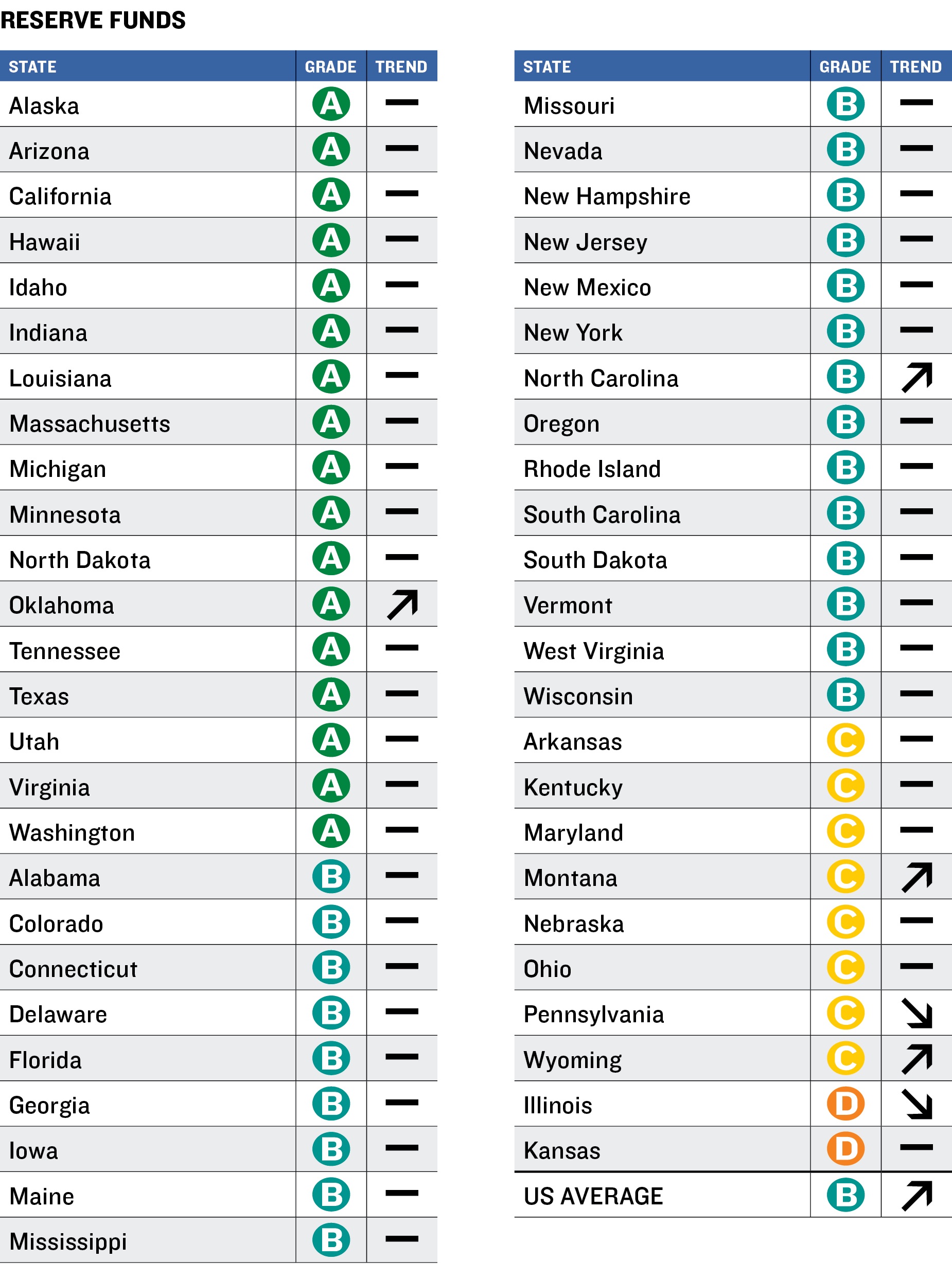

US states have amassed $62.4 billion in rainy day funds as of 2019, more than double their level at the end of the 2007–09 recession.2 States use these funds, vital tools for fiscal stability, to maintain budgetary balance in times of fiscal stress brought on by unexpected revenue declines due to economic contractions, drops in energy prices, or other financial strains, as well as by increased expenditures stemming from natural disasters such as hurricanes or floods.

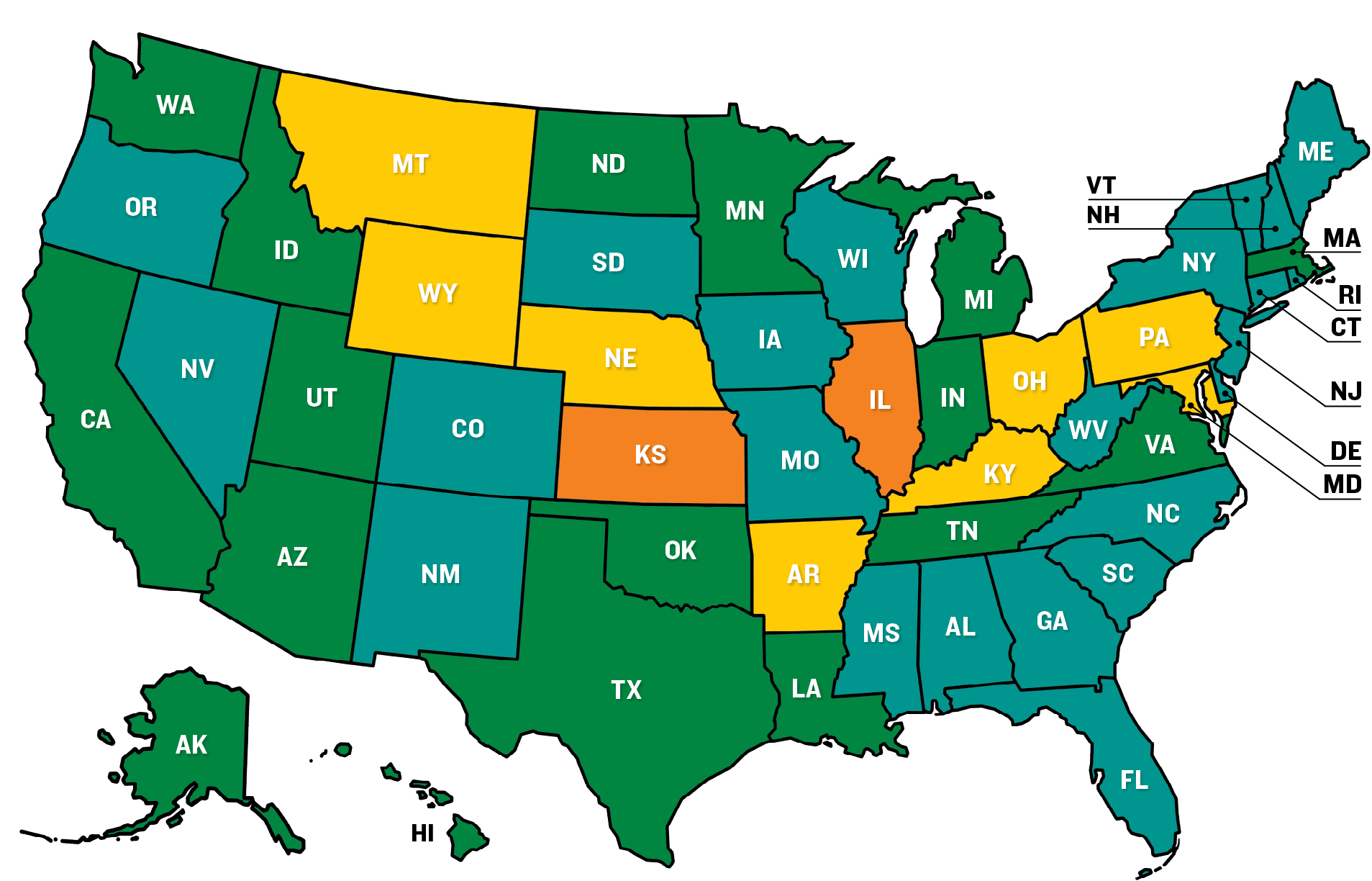

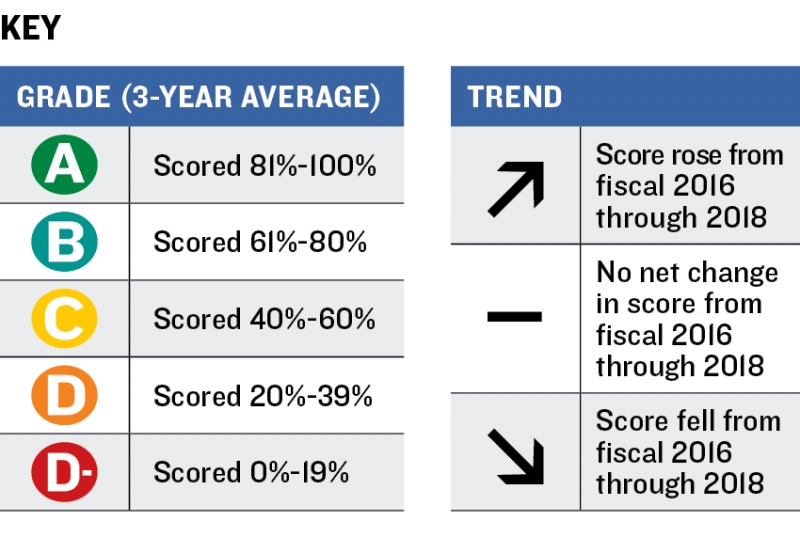

The Volcker Alliance reports Truth and Integrity in State Budgeting: Preventing the Next Fiscal Crisis (2018) and Truth and Integrity in State Budgeting: What is the Reality? (2017) graded all fifty states in five categories, including on the effectiveness of their policies to maintain, grow, and use their rainy day funds and other fiscal reserves. In our 2018 study, only seventeen states received top average grades of A in this category for fiscal 2016 through 2018, while ten were graded C or worse. The chief shortcoming identified in the 2018 evaluation was that thirty-one states had not established policies that tie rainy day fund balances or contributions to revenue volatility. The Volcker Alliance has since added Connecticut to the list of states with volatility-related policies, bringing the number without to thirty. Even many of those that maintain such a link need to strengthen their policies for governing rainy day funds—some radically.3

At the heart of this working paper is a ten-point rainy day fund action program that states should use as a template for statutory reforms in areas that need improvement most, including policies for withdrawals and replenishments, and for tying reserve contributions and balances to revenue volatility. To help guide policymakers, each action item is accompanied by an example of a state that has successfully deployed a particularly strong rainy day fund practice, including links to relevant statutes or constitutional amendments.

The size of rainy day funds varies from state to state, both in dollars and as a percentage of expenditures from the general fund, the primary vehicle for financing recurring programs. The biggest rainy day funds as measured by percentage of general fund spending include those in natural resource-rich states such as Alaska, New Mexico, and Wyoming, where extremely volatile revenues accentuate the need for fiscal buffers. In contrast, some fiscally stressed states—including Illinois, Kansas, Kentucky, New Jersey, and Pennsylvania—keep little or no rainy day funds on hand.

Florida created the first rainy day fund in 1959, spurred by challenges stemming from a crop freeze the year before.4 Thirty-one other states established funds in the 1970s and 1980s.5 Though fifteen states require a supermajority vote in the legislature to tap rainy day funds in certain instances, the reserves typically are the most efficient way for states to weather revenue declines. The alternatives would be raising taxes, slashing expenditures, or borrowing from dedicated long-term savings accounts, such as the Alaska Permanent Fund, or other funds earmarked for transportation or education.

Rules governing rainy day funds are usually set out in statutes. Yet legislators and governors typically are not penalized if they choose to forgo contributions or make appropriations at will. Nonetheless, states that fail to maintain adequate reserves may face credit rating downgrades and the uncertainty of implementing fiscal policies with little or no cushion for emergencies. Those alone are ample reasons to maintain healthy reserves to cope with the rainy days, months, and years that inevitably occur.

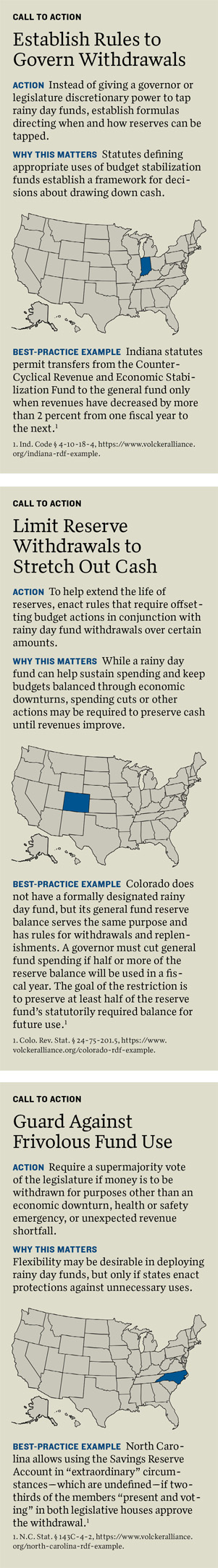

STRATEGIES: Fund Withdrawals

Setting conditions for withdrawals from rainy day funds is important to prevent them from financing the politically popular program of the moment. Whether the purpose of a withdrawal is to cover a revenue shortfall in the current fiscal year, reduce deficits from previous periods, or help pay for reconstruction after natural disasters, states should clearly define the economic or fiscal indicators that may justify drawdowns, as well as acceptable uses for the money.

Political preconditions for fund withdrawals, such as legislative approval by simple or supermajority vote, should also be codified and well understood. In this way, states can help guard against frivolous use of taxpayer dollars while directing reserve funds toward the most pressing needs.

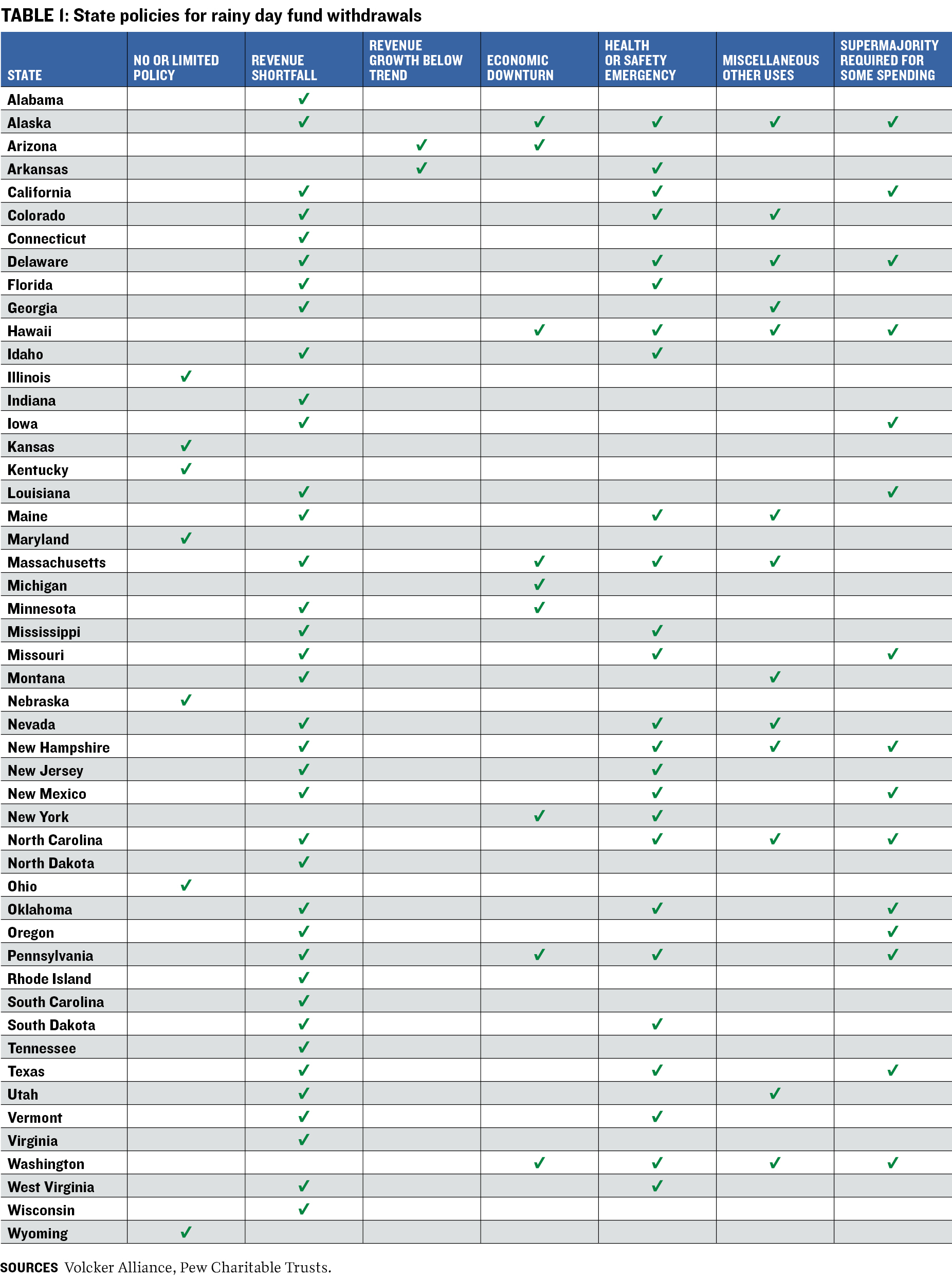

Seven states—Illinois, Kansas, Kentucky, Maryland, Nebraska, Ohio, and Wyoming—lack or have limited policies governing use of rainy day funds. Many of the other forty-three could improve their procedures for withdrawals. The ten action items in this working paper include several of the best practices we have identified for governing drawdowns.

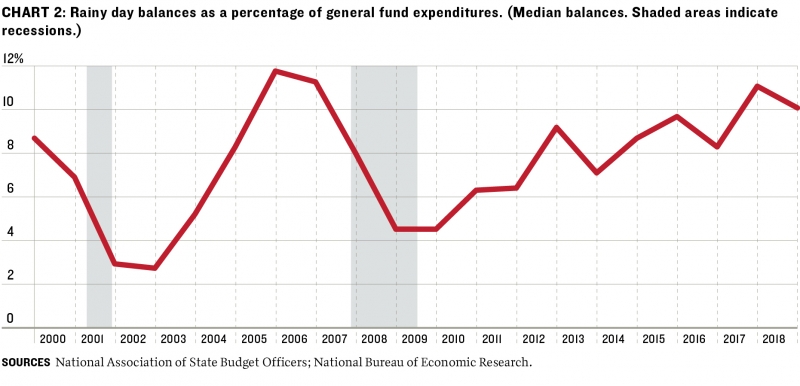

States withdraw the most from rainy day funds when tax collections decline, generally during or after recessions. For example, total state rainy day fund balances fell almost $5 billion between 2006, the eve of the last US recession, and 2010, the first full year of the current recovery, according to the National Association of State Budget Officers. In 2010, rainy day fund balances could cover only 1.6 percent of the year’s general fund spending for all fifty states.6 But as the economy and tax revenues have strengthened, rainy day fund withdrawals have shrunk and balances have rebounded to 7.3 percent of general fund expenditures.

In fact, only a handful of states have made withdrawals in the last few years.7 North Dakota, for one, took $572 million out of its budget stabilization fund to avoid spending cuts or tax increases as natural gas prices and severance tax revenues dived in its 2015–17 biennium.8 While the fund held the equivalent of 18 percent of general fund spending in 2015, the withdrawals caused the balance to plunge to 2 percent in 2017. (As gas prices have recovered, the state has rebuilt the rainy day fund to 10 percent of general fund spending.)

At the time, North Dakota law gave the governor authority to withdraw from the stabilization fund when biennial revenues were at least 2.5 percent less than estimated by the most recently adjourned special or regular legislative session. The withdrawal process was tightened in 2017 and now requires that cuts be made to agency budgets before any transfers from the fund.9 This process does not require legislative approval.10

North Dakota’s withdrawal rules are one example of how states describe the circumstances under which rainy day funds can be tapped. Thirty-nine states refer either to a revenue shortfall or an imbalance between revenues and expenditures. The statute governing Indiana’s Counter-Cyclical Revenue and Economic Stabilization Fund requires a transfer into the general fund when the annual growth rate of that fund for the current fiscal year drops by 2 percent or more from the previous one. After the state auditor and budget director certify that condition, the state treasurer makes the transfer.11

In Minnesota, which has a two-year budget, the withdrawal process begins with the commissioner of management and budget’s conclusion that the state faces an economic downturn based on various benchmarks, including lower wage growth. The commissioner then estimates whether the amount available from revenues for the remainder of the biennium will be less than needed. After obtaining the governor’s approval and consulting the Legislative Advisory Commission,12 the commissioner can move money out of the budget reserve account.”13

Twenty-five states, including New Jersey, Florida, and Washington, have legislation specifying that health and safety emergencies, such as natural disasters, are appropriate triggers for tapping rainy day funds.

Nine states link rainy day fund use to particular economic indicators that signal a downturn, in some cases in conjunction with an imbalance between expenditures and revenues.

Definitions of economic downturns can vary. In New York, the labor commissioner prepares a monthly composite index of business indicators using components such as private sector employment, average weekly hours of manufacturing workers, and total sales tax collection. The state’s reserve funds can be used only after this index declines for five consecutive months.14

Washington, meanwhile, allows withdrawals from the budget stabilization account when employment growth is forecast at less than 1 percent. The legislature must approve the move by a simple majority.15

Fifteen states specify conditions other than economic downturns, revenue shortfalls, or budgetary imbalances for dipping into rainy day funds. Georgia legislators may appropriate an amount equal to 1 percent of the preceding year’s net general fund revenue to finance K-12 school programs.16 And Maine law permits the governor to use the Budget Stabilization Fund to pay death benefits for families of law enforcement officers, firefighters, and emergency medical services workers, or to supplement school funding when a municipality is affected by a sudden and severe drop in property valuations.17

Regardless of statutes detailing the allowed use of rainy day funds, fifteen states, including California, Delaware, Oklahoma, and Oregon, take steps to avoid overuse of reserves by requiring a legislative supermajority in both houses to approve some withdrawals.

In Missouri, a two-thirds legislative majority is required to authorize rainy day fund withdrawals when revenues are less than budgeted appropriations.18 Alaska law requires a three-fourths majority of each house to tap the reserve “for any public purpose,” but a simple majority can use budget reserve funds when money available for appropriation is less than the previous year.19

STRATEGIES: Funding and Replenishment

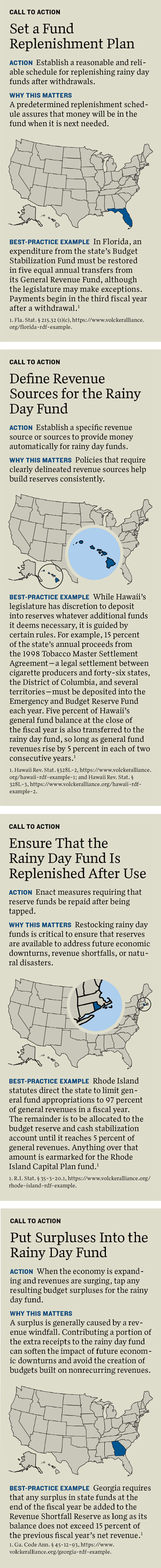

Rainy day funds are of little use if states lack statutes or other rules to ensure that reserves are replenished after they are tapped and that they keep growing until the next fiscal emergency. Only Kansas and Arkansas lack this kind of mechanism, although Kansas has set a deposit plan scheduled to take effect in fiscal 2020.20 And while several states have found ways to get around replenishment rules, at least twenty-six have taken advantage of the recovery in the economy and in tax receipts after the 2007–09 recession to amass more in rainy day funds than they had before the downturn.21

States employ six basic methods to govern contributions to rainy day funds. Some states, including Hawaii, Texas, and Michigan, use more than one strategy, but most restrict their funding guidelines to a specific approach.

Twenty-five states, including Delaware, Georgia, Idaho, and Indiana, must move a portion of their unencumbered general fund balances, including surpluses from the current or a recently completed fiscal year, into their rainy day funds.

In New Hampshire, the account is replenished at the end of each two-year budget cycle, when the comptroller transfers the balance from the general fund.22 In other states, only a portion of surplus revenues are designated for the rainy day fund. In Maine, 80 percent of the unencumbered general fund balance is moved to the Budget Stabilization Fund after the state satisfies a series of statutory requirements. This mandated transfer ceases only when the reserve fund reaches 18 percent of general fund monies from the preceding year.23 Though Maine’s stabilization fund was almost empty from 2009 to 2011, it currently could cover 8 percent of general fund expenditures.

After drawing down surpluses, the most common approach for contributing to a rainy day fund is to tap a dedicated funding source. Sixteen states follow this procedure. Among the most typical sources are specific portions of general fund revenues or a defined portion of a single revenue source, such as severance tax collections. For instance, the Washington Constitution requires the state to deposit into the budget stabilization account at the end of each fiscal year an amount equivalent to 1 percent of general fund revenues.24 As of 2019, the account contained the equivalent of 5 percent of general fund spending.

Washington follows another approach. In 2011, voters approved a measure to transfer an additional three-quarters of “extraordinary revenue growth” to the state’s rainy day fund at the end of a biennial budget cycle. Extraordinary in this case is defined as two-year revenue growth that is one-third higher than the average percentage growth in revenues for the prior five budget terms. The exception is if employment growth in the preceding biennium is less than 1 percent in each fiscal year.25

Maryland’s code obliges the governor to appropriate cash to the rainy day fund based on a sliding scale that links the contribution amount to the size of the Revenue Stabilization Account relative to general fund revenues. If the account balance drops to the equivalent of less than 3 percent of estimated general fund revenues in a given fiscal year, the governor is required to include $100 million in the proposed budget, which must be approved by the legislature. If the balance is between 3 percent and 7.5 percent, the appropriation drops to $50 million.26 The state currently has 5 percent of general fund expenditures in the stabilization account.

In nine states, including Missouri, North Carolina, and Virginia, statutes do not spell out the specific revenue sources for rainy day funding. Generally, these states have other statutory guidance ensuring that reserve accounts are funded and replenished, but details—such as where the money comes from or how much is deposited at any one time—are left to the legislature and executive branch.

In New York, the law puts rainy day funding decisions in the hands of the budget director, who may make an annual request that the comptroller transfer up to 0.75 percent of that fiscal year’s general fund spending into its rainy day reserve.27 New York’s fund currently contains the equivalent of 2 percent of general fund spending.

The state has another policy shared by seven others: statutes spelling out time frames for depositing money into rainy day funds or repaying withdrawals. In New York, money taken out of the reserve fund must be repaid within three years.28 In Rhode Island, funds must be repaid during the fiscal year that follows a transfer from the budget reserve and cash stabilization fund.29 That account has remained at 5 percent of general fund spending since 2012.

Minnesota, Montana, Nebraska, and Oklahoma make deposits into their rainy day funds when revenues are at a set level above the revenue estimate.30 A Wisconsin act created a similar rule in 2001. When tax revenues are above projections, half of the unexpected collections go into the budget stabilization fund. This is in effect only if the fund balance is not more than 5 percent of general fund expenditures.31 From 2013 through 2018, Wisconsin’s stabilization account had the equivalent of 2 percent of that spending.

Arizona has a statutory formula tying contributions to its Budget Stabilization Fund to increases in total personal income tax collections adjusted for inflation. However, the legislature stopped adding to the fund in 2015 and formally suspended the policy for 2018, 2019, and 2020.32 Even so, the stabilization fund totaled $468 million,33 or 4 percent of general fund spending, as of May 26, 2019. Governor Doug Ducey signed a bill on May 27 adding $542 million to the rainy day account, bringing it to a record $1 billion.34

STRATEGIES: Rainy Day Funds and Volatility

As recently as two decades ago, a minimum rainy day fund balance equivalent to 5 percent of general fund revenues or expenditures was widely regarded as sufficient to protect states from having to make severe cuts to balance budgets during economic downturns.35 Florida is one of several states still adhering to this rule of thumb for its Budget Stabilization Fund.36

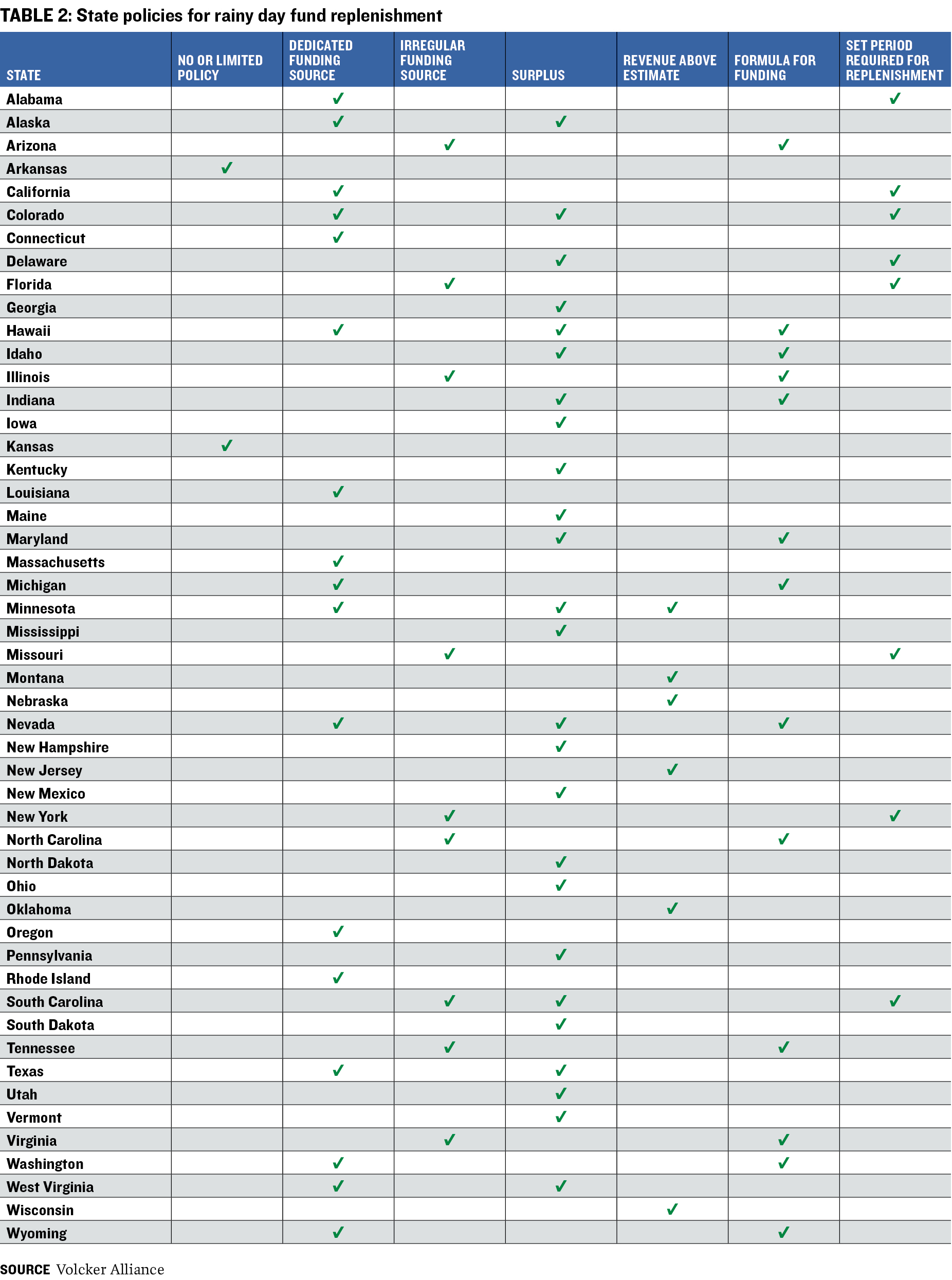

While the origin of the 5 percent figure is obscure, a nearly two-decades-old paper by Philip G. Joyce, then an associate professor of public administration at George Washington University and now senior associate dean at the University of Maryland School of Public Policy, argued that states should tie the amount in their reserves to the historical volatility of their economy and revenue structures rather than to a fixed target.37 As other academics have joined Joyce’s camp,38 twenty states have scrapped the traditional one-size-fits-all approach in favor of a more flexible standard that reflects how much their revenue and economies change from year to year. Indeed, one of the key determinants of the Volcker Alliance’s grades for rainy day funds is whether a state has factored revenue volatility into determining the amount it should set aside. All seventeen states that received a top A grade in reserve funds for fiscal 2016 through 2018 followed this standard.

As of fiscal 2019, state rainy day fund assets totaled $62.4 billion, according to data from the National Association of State Budget Officers. The total is one of the highest since at least 2000 and more than double the level after tax collections plummeted in the 2007–09 recession. But with states’ tax revenue increasingly volatile in recent years, the need for a shift to a flexible standard has become more pressing. From 2000 to 2013, for example, forty-two states showed a rise in such volatility.39

States may adopt rainy day fund policies based on volatility for different reasons. Montana and North Dakota depend on tax revenues from the production of oil, gas, and minerals that can drop precipitously when energy prices fall and balloon when they recover. California and Massachusetts, meanwhile, are among states that rely on capital gains tax receipts, which can ebb and flow with the fortunes of financial markets.40

Connecticut became the most recent state to introduce volatility into its budget reserve fund equation, with legislation passed in 2017. What made Connecticut change the policy was the realization that its income had fluctuated dramatically because of its dependence on capital gains taxes paid by hedge fund managers and others in the state’s large financial services industry. Its progressive income tax for individuals, with rates of 3 percent to 6.99 percent, exacerbated the volatility: Good years on Wall Street would yield bonanzas for tax collectors, while bear markets left the state short.

Connecticut now limits the amount of personal income tax collections that can be used to balance the budget to an exact sum, which increases over time. The cap was set at $3.1 billion for 2019 and $3.3 billion for 2020. Any amount above this so-called volatility cap is automatically transferred to the state’s Budget Reserve Fund.

While most states allow the legislature to override rules governing rainy day fund contributions, Connecticut does not give lawmakers that option. As part of the state’s new policy, legislators passed a so-called bond lock requiring that as long as any general obligation debt issued from May 15, 2018, to June 30, 2020, is outstanding, the state must comply with the volatility cap for stocking the reserve fund.41

States that account for volatility in setting their goals for reserve funds use a variety of other mechanisms to link the two.

Nine states—Alaska, California, Louisiana, Massachusetts, North Dakota, Oklahoma, Texas, Utah, and Washington—rely on specific revenue streams, typically related to natural resources or capital gains. For instance, since 1985 Oklahoma has had a Constitutional Reserve Fund, which receives 100 percent of the state’s surplus after expenditures at yearend. Increasing concerns over swings in proceeds from oil and mineral extraction, as well as from corporate income taxes, prompted legislators in 2016 to create the Revenue Stabilization Fund, an additional reserve. It receives contributions from gross production taxes on oil and gas and from the corporate income tax when either exceed their five-year averages.42 Louisiana, meanwhile, draws rainy day fund deposits from excess revenues from oil severance taxes, royalty and bonus payments, or rentals.43 Similarly, Alaska’s constitution requires that the state Budget Reserve Account get any monies generated by the resolution of disputes over mineral-related income.44

Seven states—Arizona, Idaho, Indiana, Michigan, Minnesota, North Carolina, and Tennessee—use economic formulas to develop funding levels. Indiana contributes to the state fund when personal income grows more than 2 percent from the previous year.45 Idaho law requires the state controller to transfer money from the general fund to the budget stabilization fund when the former’s total revenues at the end of the fiscal year exceed those of the previous year by more than 4 percent.46

In Minnesota, Montana, North Carolina, Utah, and Virginia, rainy day fund withdrawals and replenishments must be accompanied by a study or analysis of state revenue volatility. Utah requires that the executive and legislative branches produce a report every three years that analyzes reserve fund balances in relation to revenue volatility, including federal funding.47

Conclusion

This working paper is a call to action for states that need to strengthen their rainy day fund policies. Wherever needed, these improvements must include safeguards against improper withdrawals, statutory guidelines for replenishments, and the consideration of revenue volatility to help determine funding levels.

In the recovery that has followed the end of the Great Recession,48 states have steadily rebuilt rainy day funds that were depleted in the contraction. If recent history is a guide, the funds will continue to grow until about a year after the next recession begins. At that point, states may well face the consequences of not following the ten action items outlined in the preceding pages.

In the appendices that follow, readers will find tables and charts that, combined with the action items, comprise a best-practices resource center for rainy day fund improvement. Among the appendix items are comprehensive tables and charts on the history of rainy day funds over the past two decades and the Volcker Alliance’s most recent grades and tables on reserve funds, published originally in the study Truth and Integrity in State Budgeting: Preventing the Next Fiscal Crisis. While winning an A grade for reserves doesn’t guarantee long-term fiscal success, the mark does signal that a state values budgetary stability and sustainability over one-time strategies and is willing to invest substantial amounts of taxpayer cash to help reach these goals.

Appendix

APPENDIX A: RESERVE FUND GRADES, FY 2016-2018

|

This table contains assessments of states’ balances and policies for reserve funds for fiscal 2016 through 2018. States were graded on a scale of A to D-minus, the lowest possible, on whether they had policies (set by constitution, referendum, statute, or other formal rule) for the use and replenishment of rainy day funds; whether the rainy day fund balance (or contribution) was specifically tied to the historical trend of revenue volatility; and whether the rainy day fund or general fund balances were greater than zero on the first day of the fiscal year.

APPENDIX B: TOTAL RAINY DAY FUND BALANCES, 2000-19

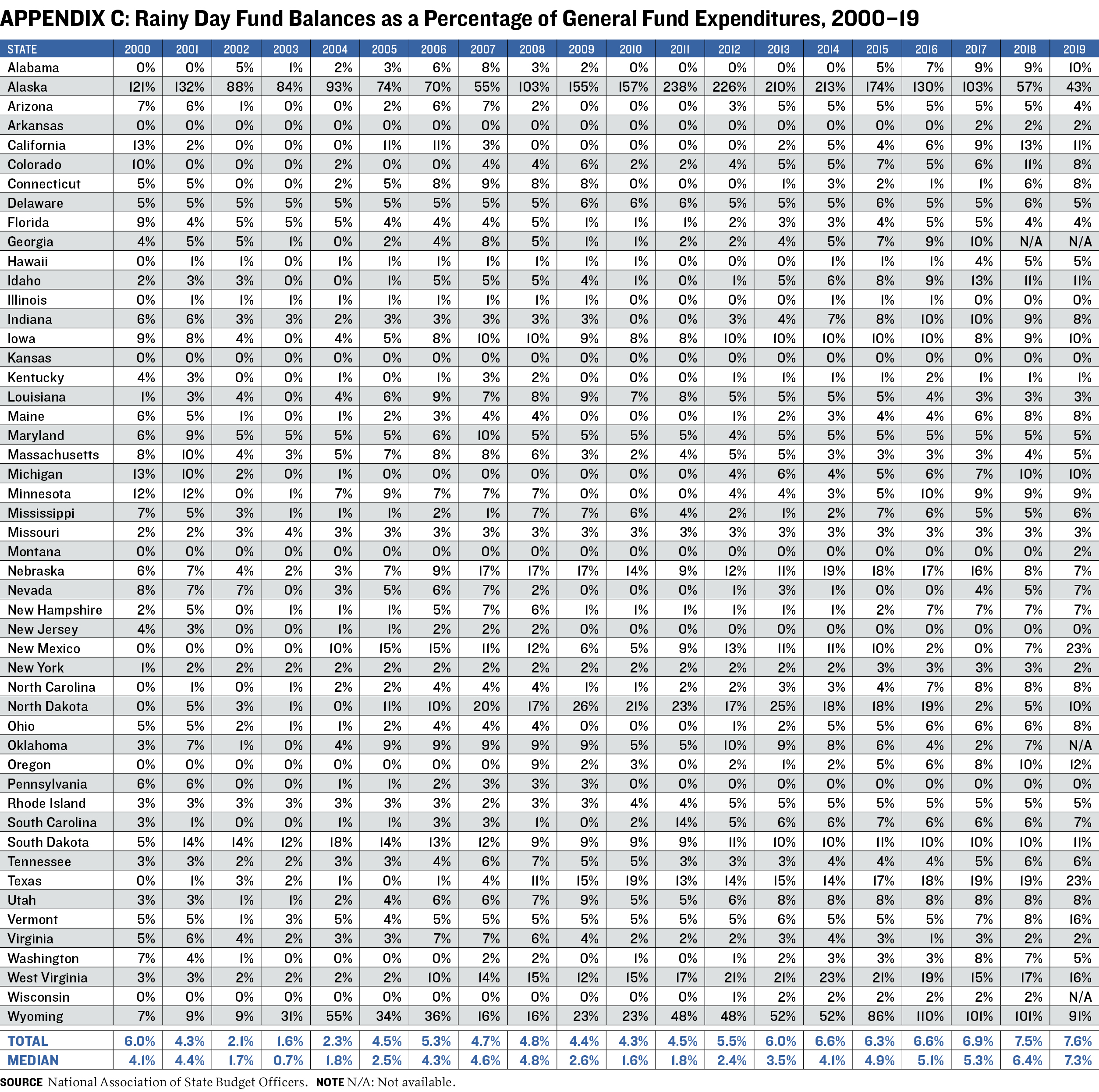

APPENDIX C: RAINY DAY FUND BALANCES AS A PERCENTAGE OF GENERAL FUND EXPENDITURES, 2000-19

Endnotes

1. State rainy day fund data prepared for the Volcker Alliance by the National Association of State Budget Officers, April 12, 2019.

2. Ibid.

3. The Volcker Alliance, Truth and Integrity in State Budgeting: Preventing the Next Financial Crisis, 2018, Appendix A: 50–99, https://www.volckeralliance.org/publications/truth-and-integrity-state-….

4. Todd Haggerty and Jonathan Griffin, “A Drop in the Bucket,” State Legislatures Magazine, April 2014, http://www.ncsl.org/research/fiscal-policy/a-drop-in-the-bucket.aspx.

5. Gary A. Wagner and Russell S. Sobel, “State Budget Stabilization Fund Adoption: Preparing for the Next Recession or Circumventing Fiscal Constraints?” Public Choice 126, no. 1–2 (January 2006): 181, https://link.springer.com/article/10.1007/s11127-006-7752-x.

6. National Association of State Budget Officers, Fiscal Survey of the States, Fall 2018, vii, https://higherlogicdownload.s3.amazonaws.com/NASBO/9d2d2db1-c943-4f1b-b…\.

7. Kathryn Vesey White (director, budget process studies at the National Association of State Budget Officers), in discussion with Richard Greene, May 2019.

8. Report of the North Dakota Legislative Management, 2019, 48, https://www.legis.nd.gov/files/resource/65-2017/legislative-management-….

9. N.D. Cent. Code § 54-27.2-03, https://www.legis.nd.gov/cencode/t54c27-2.pdf#nameddest=54-27p2-01.

10. Ryan Skor (director of finance, office of the North Dakota state treasurer) in discussion with Katherine Barrett, May 2019.

11. Ind. Code § 4-10-18-4, http://iga.in.gov/legislative/laws/2018/ic/titles/004.

12. The commission has authority to review and grant requests by state departments and state agencies for funding.

13. Minn. Stat. § 16a.152, Subd. 4, https://www.revisor.mn.gov/statutes/2015/cite/16A.152/subd/16A.152.8#st….

14. N.Y. Con. Law § 6- 92-CC, https://www.nysenate.gov/legislation/laws/STF/92-CC.

15. Wash. Const. art. VII, § 12, http://leg.wa.gov/LawsAndAgencyRules/pages/constitution.aspx.

16. Ga Code Ann. § 45-12-93(c), https://advance.lexis.com/container?config=00JAAzZDgzNzU2ZC05MDA0LTRmMD….

17. Me. Rev. Stat. § 5-1532, https://legislature.maine.gov/statutes/5/title5sec1532.html.

18. Mo. Const. art. IV, § 27a, http://www.moga.mo.gov/MoStatutes/ConstHTML/A04027a1.html.

19. Alaska Const. art. IX, § 17, https://ltgov.alaska.gov/information/alaskas-constitution/.

20. State of Kansas Governor’s Budget Report, Volume 1, Fiscal Year 2020, January 16, 2019, 31, https://budget.kansas.gov/wp-content/uploads/FY_2020_GBR_Vol1-02-13-201….

21. Pew Charitable Trusts, Fiscal Fifty: State Trends and Analysis, “Budget Surpluses Are Helping Many States Boost Their Savings,” May 3, 2019, https://www.pewtrusts.org/en/research-and-analysis/data-visualizations/….

22. N.H. Rev. Stat. Ann. § 9:13-e, http://www.gencourt.state.nh.us/rsa/html/I/9/9-13-e.htm.

23. Me. Rev. Stat. § 5-4-142-1536, http://legislature.maine.gov/statutes/5/title5sec1536.html.

24. Wash. Const. art. VII, § 12(b)(1), http://leg.wa.gov/LawsAndAgencyRules/pages/constitution.aspx.

25. Wash. Const. art. VII, § 12(2)(h).

26. Md. Stat. § 7-311, http://mgaleg.maryland.gov/webmga/frmStatutesText.aspx?article=gsf§….

27. N.Y. Finance Law § 92-CC, http://public.leginfo.state.ny.us/lawssrch.cgi?NVLWO:.

28. Ibid.

29. R.I. Stat. § 35-3-20, http://webserver.rilin.state.ri.us/Statutes/TITLE35/35-3/35-3-20.HTM.

30. Neb. Rev. Stat. § 77-4602, https://nebraskalegislature.gov/laws/statutes.php?statute=84-612.

31. Wisconsin Legislative Fiscal Bureau, The Budget Stabilization Fund and the General Fund Reserve Requirement, January 2009, 2–3, https://docs.legis.wisconsin.gov/misc/lfb/informational_papers/january_….

32. State of Arizona, FY 2018 Appropriations Report, June 2017, 429, https://www.azleg.gov/jlbc/18AR/FY2018AppropRpt.pdf.

33. Rainy day fund total is higher than the amount reported in Appendix B, which is based on earlier statistics.

34. Office of the Governor, “Passed: Arizona’s Balanced Budget,” news release, May 27, 2019 https://azgovernor.gov/governor/news/2019/05/passed-arizonas-balanced-b….

35. Katherine Barrett and Richard Greene, “The Gospel of Guidelines,” Governing, September 1999, 68.

36. Fla. Stat. § 215.32 (c), http://www.leg.state.fl.us/Statutes/index.cfm?App_mode=Display_Statute&….

37. Philip G. Joyce, “What’s So Magical about Five Percent? A Nationwide Look at Factors That Influence the Optimal Size of State Rainy Day Funds.” Public Budgeting & Finance, December 17, 2002, https://onlinelibrary.wiley.com/doi/abs/10.1111/0275-1100.00050.

38. Kim S. Rueben and Megan Randall, “Budget Stabilization Funds: How States Save for a Rainy Day,” Urban Institute, November 27, 2017, https://www.urban.org/research/publication/budget-stabilization-funds; Pew Charitable Trusts, Why States Save, December 2015, https://www.pewtrusts.org/en/research-and-analysis/reports/2015/12/why-….

39. Donald Boyd and Lucy Dadayan, “State Tax Revenue Forecasting Accuracy,” Nelson A. Rockefeller Institute of Government, September 2014, 20–23, https://www.researchgate.net/publication/267623268_Growing_Volatility_i….

40. Ashwin Bhat, “State Budgets in 2019,” Northern Trust Asset Management, https://cdn.northerntrust.com/pws/nt/documents/commentary/state-budget-….

41. Office of Legislative Research, Connecticut’s Volatility Cap, December 7, 2018, https://www.cga.ct.gov/2018/rpt/pdf/2018-R-0296.pdf.

42. David Blatt, “Unheralded Law Puts Increased Funding in Doubt,” Oklahoma Policy Institute, May 2, 2019, https://okpolicy.org/unheralded-law-puts-increased-funding-in-doubt/.

43. La. Const. art. VII, § 10.3 http://senate.la.gov/Documents/Constitution/Article7.htm.

44. Alaska Const. art. IX, § 17, https://ltgov.alaska.gov/information/alaskas-constitution/?doing_wp_cro….

45. Ind. Code § 4-10-18-4, http://iga.in.gov/legislative/laws/2018/ic/titles/004.

46. Idaho Stat. § 57-814 (2), https://legislature.idaho.gov/statutesrules/idstat/title57/t57ch8/sect5….

47. Utah Code § 63J-1-205, https://le.utah.gov/xcode/Title63J/Chapter1/63J-1-S205.html.

48. National Bureau of Economic Research, US Business Cycle Expansions and Contractions, April 23, 2012, https://www.nber.org/cycles/US_Business_Cycle_Expansions_and_Contractio….

The research for this working paper was made possible in part by grants from Arnold Ventures and the Peter G. Peterson Foundation. The statements made and views expressed are solely the responsibility of the authors. We acknowledge the considerable support provided by Paul A. Volcker, the Volcker Alliance’s founder and chairman. The Volcker Alliance is thankful to all of the research partners and staff who helped make this report possible.