'Texas Rich' gives Lone Star State edge addressing Harvey’s damages

This blog was originally published August 31, 2017 by Bond Buyer.

Even with Hurricane Harvey pouring more than 9 trillion gallons of water on Houston and the nearby Gulf Coast and causing tens or even hundreds of billions of dollars in damage, Texas’s state government is still Texas Rich. And that may be the Lone Star State’s great advantage when it comes to paying for some of vast cleanup and reconstruction costs that private insurers and the federal government may not be willing or able to assume.

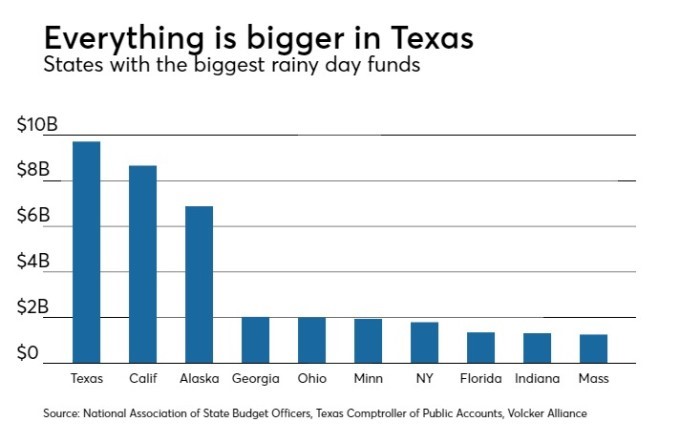

Fueled by oil and natural gas production taxes, Texas’s Economic Stabilization Fund, the state’s rainy day fund, had $9.7 billion in its coffers as of June 30, 2016, the biggest such reserve in any state, according to Comptroller Glenn Hegar’s office. Indeed, preliminary results from a forthcoming Volcker Alliance study of all 50 states’ budget practices show that Texas is one of only 14 states winning top honors in that fiscal year for the strength of its fiscal reserve policies. To join that elite club, states must replenish reserve drawdowns, tie rainy day fund balances to volatility in state revenues, and maintain positive general fund balances at the start of a fiscal year.

According to the comptroller’s office, the Texas constitution permits lawmakers to tap the stabilization fund to close a budget deficit, projected shortfall in future revenue, or for “any other purpose the Legislature chooses at any time.” Covering deficits or revenue shortfalls requires a three-fifths majority vote, while using the fund for general purposes needs a two-thirds of legislators to assent. But there is already a precedent for deploying state revenues to meet pressing spending needs, especially for infrastructure. In 2014, voters approved a constitutional amendment that gave half of the Economic Stabilization Fund’s share of oil and gas levies to the State Highway Fund through the end of 2024. Miles upon miles of flooded Texas streets and highways suggest that this fund may be deployed in ways never dreamed of when the referendum became law.

Partly because of its wealth of natural resources, Texas has billions in other financial reserves as well. Besides the Economic Stabilization Fund, the University of Texas Endowment, commonly known as UTIMCO, reported $40.5 billion in assets as of July 31, while the Permanent School Fund, part of which is earmarked for guaranteeing school district bonds (of which we may see a new crop given the flood damage) had another $37.3 billion, according to its latest annual report. The school fund guaranteed about $4.3 billion in public and charter school debt issues and provided an additional $1.06 billion in state aid to schools in the year ended Aug. 31, 2016.

Texas may not threaten its triple-A credit rating if it decides to dip into its reserves or guarantees debt to help repair some of Harvey’s damage. A recent Pew Charitable Trusts report on rainy day funds observes that “states that make withdrawals from reserves during recessions, or when an event such as a natural disaster lowers revenue, will not necessarily jeopardize their credit ratings as long as other budgetary actions meant to address the decline in revenue are also taken.” Pew recommended that decisions to use rainy day funds be based “on the state’s fiscal situation, withdrawing money as appropriate during budget crises but resuming deposits when economic and fiscal conditions improve.” Texas has followed that policy for years, and even spending in the wake of Harvey may not force it off course.