Roots of the Next Financial Crisis: The Last One’s Veterans Give Views

The following is an excerpt from Reuters' Financial Regulation Forum blog. Read the original article in its entirety here.

There is a general consensus that the next financial crisis will follow the familiar arc of bubble, falling asset values, a run, credit/liquidity crunch, finger-pointing, new regulation, financial innovation, and unintended consequences for both regulation and innovation. There is less consensus about the where, when, how, and why.

Perceived risks range from disruptive financial technologies and shadow banking to political turmoil in Brazil and economic weakness in China.

I asked experts including policy veterans of the last crisis for their thoughts on the near-term probability of another one, including their views on sources of risk listed below. Their responses, which reflect their own views and not necessarily the views of the organizations that they work for, are set out below this list.

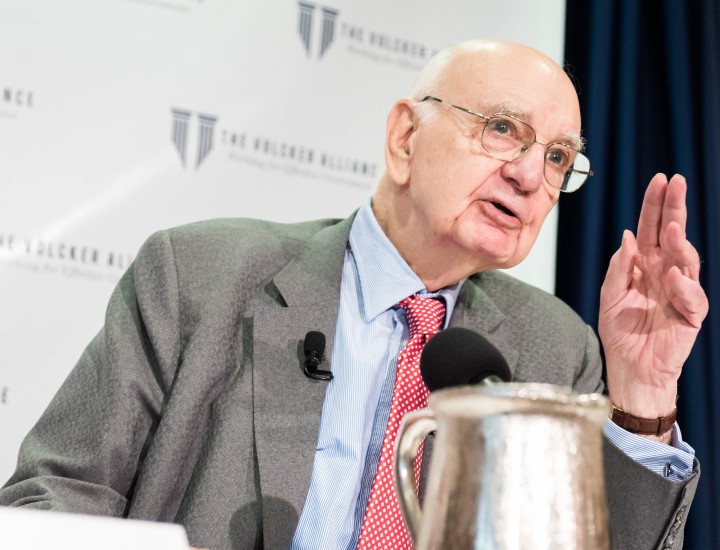

Gaurav Vasisht, Director of Financial Regulation, the Volcker Alliance; Executive Deputy Superintendent of the Banking Division of the New York State Department of Financial Services (2012 – 2013).

Eight years following the onset of the crisis the risk of runs and fire sales remains all too real. A fundamental reason why is that financial institutions without access to the bank safety net and which operate outside the strictures of prudential regulation remain heavily reliant on runnable short term funding techniques to finance their long term assets.

This funding structure introduces in the markets the risk of runs that plagued depository institutions before deposit insurance. Given the increasing interconnectedness of the markets, including through central clearing counterparties and investment vehicles, the failure or stress of a large market participant can be transmitted astonishingly rapidly throughout the system, possibly leading to cascading market-wide failures.

Compounding matters, our regulatory framework itself remains a problem. It deprives regulators of a comprehensive understanding of the risks in the system and the tools necessary to mitigate those risks. As an example, the Federal Reserve, which has a mandate for financial stability lacks reach into systemically important parts of the financial markets, while the SEC and CFTC, which may have the reach appear to not have a stability mandate. This makes implementation of financial stability policy difficult to achieve.