Paul A. Volcker Issues a Statement on Proposed Changes to the Volcker Rule

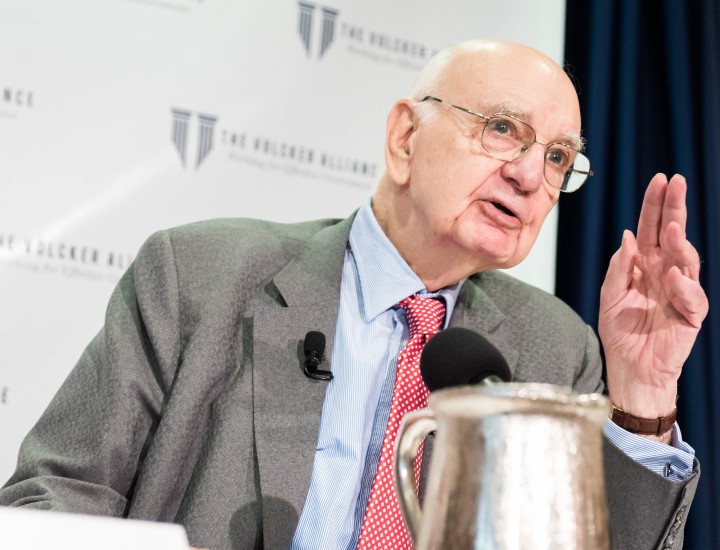

In light of the Federal Reserve’s proposal to alter the so-called Volcker Rule, Paul A. Volcker, former Chairman of the Federal Reserve Board of Governors from 1979 to 1987, issued the following statement:

“I welcome the effort to simplify compliance with the Volcker Rule. What is critical is that simplification not undermine the core principle at stake—that taxpayer-supported banking groups, of any size, not participate in proprietary trading at odds with the basic public and customers’ interests. I trust the final rule will strongly maintain that position by, as intended, facilitating its practical application.”

The Volcker Rule is a federal regulation that generally restricts US banks from conducting speculative investment activities with their own accounts—proprietary trading—and limits their ownership of and investment in hedge funds and private equity funds. The regulation was proposed by Mr. Volcker while he served as chair of the President’s Economic Recovery Advisory Board, created to advise the Obama Administration on economic recovery matters. The rule was signed into law by President Barack Obama as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act on July 21, 2010, and came into effect on July 21, 2015.

Mr. Volcker is currently chairman of the Volcker Alliance, which he founded in 2013 to advance effective management of government to achieve results that matter to citizens. The nonpartisan Alliance works toward that objective by partnering with other organizations—academic, business, governmental, and public interest—to strengthen professional education for public service, conduct needed research on government performance, and improve the efficiency and accountability of governmental organization at the federal, state, and local levels.