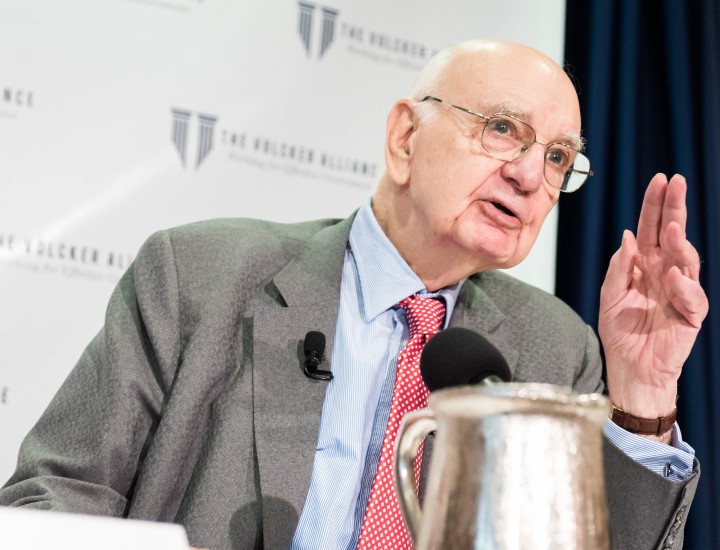

Gaurav Vasisht Addresses the Financial Stability Board on Too-Big-to-Fail Reforms

Remarks of Gaurav Vasisht

Senior Vice President and Director, Financial Regulation

The Volcker Alliance

At the Financial Stability Board Workshop to Evaluate Too-Big-To-Fail Reforms

Hosted by the Federal Reserve Bank of New York

September 16, 2019

Thank you for the opportunity to present my views here today. In my remarks, I will focus on the effect of too-big-to-fail (“TBTF”) reforms on the US financial system. My overall assessment is that while TBTF reforms have made the financial system more resilient, the system isn’t safe enough and there is much still left to be done. My concern, however, is that instead of tending to the unfinished business, policymakers once again appear to be easing important requirements during the good times—even as vulnerabilities build—to our possible later detriment.

For this reason, the FSB’s evaluation of TBTF reforms is so critical—the review will allow policymakers to take stock of where we stand and permit them to consider what we should do next and how. But the FSB will face challenges along the way, and I’d like to detail some of them here today.

First, a process challenge—soliciting an appropriately broad range of views on the evaluation. The FSB has received 17 comment letters on its consultation so far. Of these, 11 are from industry groups and most of those represent the views, to varying degrees, of major banking organizations. There is nothing wrong with those views, of course; in fact, they are very well presented and extremely informative. But it will be important for the FSB to remain mindful of the resource gap between those who speak for the global systemically important banks (“GSIBs”) and those who might present a very considered but diverging perspective. For this reason, and to prevent an “echo chamber” dynamic, it will be up to the FSB to try even harder to solicit other views. This workshop is an important element to do so but the more effort the FSB dedicates to this objective the more credibility it will garner for its efforts. You should not conclude your review until you have got wider input.

Second, challenging the claim that post-crisis reform is complete and that regulators should now focus on implementing and looking for opportunities to “recalibrate” and “tailor.” This overarching claim, which is articulated in many of the comment letters, rests on several underlying assertions, including that—we have overcome moral hazard; the TBTF subsidy has been eliminated; banks have more capital and liquidity than they might need; systemically important banks are resolvable; and resolution plans are ready, if necessary. It also rests on the notion that reforms have unnecessarily cost us GDP and market liquidity, not just as part of a transition to a safer system, but permanently, and that we must, therefore, ease requirements, including to prevent a migration of activities to the unregulated sectors.

I’m a bit less optimistic. My view is that, given the economic conditions, the state of monetary policy and our countercyclical aims, banks may be better off with more equity capital, not less. And I don’t believe it will be smooth sailing the next time around, as these assumptions might lead us to believe. I also think that, for whatever it is now, market perception of TBTF institutions can change quickly. So, the “mission accomplished” view appears to be misguided, and the FSB should question any assumptions that may lull regulators into a false sense of security and complacency.

In some cases, the FSB may need to go even further. For instance, even though there is no conclusive evidence that market liquidity has deteriorated—and plenty of compelling evidence to the contrary—let’s assume for a moment that liquidity has diminished. The analysis cannot stop there. To recommend further action, policymakers must also (1) analyze whether the reduction is a problem for the markets; and, if so (2) whether it is because of regulation; and, if so (3) which ones. They must also assess whether those regulations are a net positive or a net negative for financial stability and whether any considered rollback measure would increase liquidity and economic growth without costing us resilience.

Unless these questions are answered conclusively, it would be imprudent to consider further deregulatory efforts in the name of market liquidity. It is worth remembering that liquidity was plentiful before mid-2007 and dried up rapidly thereafter to the point of nonexistence. Given that difficult lesson, the interests of traders and bankers to be awash in liquidity during normal times conflicts with the public interest.

Third, taking stock of the deregulatory efforts already underway. Over the past two years, global regulators have taken steps to, as they say, simplify and recalibrate important requirements. This is particularly true in the United States where policymakers are implementing legislative and administrative changes to ease leverage and risk-based capital requirements, including for deposit subsidiaries; reduce the frequency and stringency of stress testing and resolution planning exercises; and narrow the scope of the Volcker Rule.

While a few of the notices of proposed rulemaking provide some limited information on the effect of individual changes, there is no analysis of the cumulative impact of all the implemented and contemplated measures to financial system resilience. As part of its analysis on TBTF, the FSB should appreciate the full effect before contemplating additional recalibration. In addition, as former Deputy Governor of the Bank of England Sir Paul Tucker has recommended, regulators should consider publishing the net effects of deregulatory and re-regulatory changes on each firm’s capital and liquidity requirements.

Fourth, considering the unfinished business of financial reform. How will we handle the failure of a major central counterparty? What about a big regional bank? Is every GSIB now resolvable without a taxpayer bailout? More ambitiously, can we handle the simultaneous distress or failure of multiple U.S. GSIBs? Those are the core questions about TBTF—they probe whether next time, we will be able to handle the failure of individual intermediaries of all kinds.

In terms of effective monitoring, how can we make stress testing more effective and better able to capture a crisis dynamic, including second order and boomerang effects? Some of these and other questions are under consideration elsewhere in the FSB’s workstreams and are beyond the scope for this exercise. But a review of the effectiveness of TBTF reforms should not be considered in isolation and, to be meaningful, should factor in the unfinished business. It will be far easier to ease requirements in the name of simplification and recalibration than it will be to strengthen and sharpen regulation to finish the outstanding work. Decoupling the two objectives risks undermining system resilience.

Finally, understanding the many opaque corners of the financial system that can impact the financial condition of large banks. Derivatives, securities financing transactions, the markets for leveraged loans and collateralized loan obligations are all areas where regulators and policymakers lack visibility. They are also areas where regulators must develop a clear understanding to meet their financial stability mandate. I’m glad the FSB is shining a light into some of these areas and I look forward to its analysis forming the basis of future policy, including for the so-called shadow banking sector, to ensure the stability of the financial system.

I look forward to your questions. Thank you!