Financial Regulation Initiative

Financial Regulation Initiative

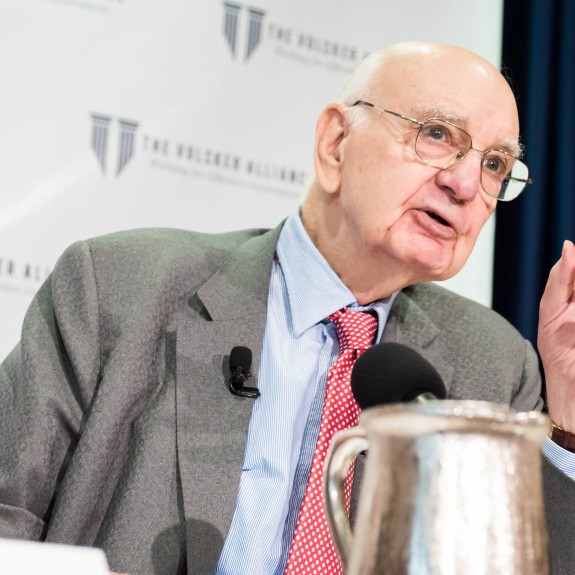

Paul A. Volcker, founding chairman of the Volcker Alliance, dedicated a large part of his career to building and maintaining a financial system that Americans can trust. He continued that effort at the Volcker Alliance. President Obama used these words to describe Mr. Volcker’s enduring motivation: “Paul Volcker believed not just in the power of markets but in the corresponding power of the government’s duty to make sure those markets work for everyone.”

Mr. Volcker is best known for bringing high inflation under control as chairman of the Federal Reserve from 1979 to 1987. As head of the President’s Economic Recovery Board from 2008 to 2011, Mr. Volcker advised the Obama Administration on its response to the Great Recession. The Volcker Rule—part of the Dodd-Frank Wall Street Reform and Consumer Protection Act passed in 2010—banned proprietary trading in commercial banks. Mr. Volcker described the rule as “the simple idea that ‘thou shall not gamble with the public’s money.’” His concern over lingering systemic risk in the federal financial regulatory system following the Great Recession, as well as the need for the regulatory system to evolve to manage new risks effectively, led him to launch the Financial Regulation Initiative at the Volcker Alliance.

At the Volcker Alliance, Mr. Volcker laid out a vision to reshape the financial regulatory system for the twenty-first century. He worried that after the Great Recession, the system for regulating financial institutions in the United States remained highly fragmented, outdated, and ineffective. A multitude of federal agencies, self-regulatory organizations, and state authorities shared oversight of the financial system under a framework riddled with regulatory gaps, loopholes, and inefficiencies. His aim was to present a simpler, clearer, adaptive, and resilient regime, on par with the modern regulatory frameworks of other developed countries, with a mandate to deal with the modern financial system and remain capable of keeping pace with the evolving financial landscape. The first report of the Volcker Alliance’s Financial Regulation Initiative provided detailed recommendations on federal financial regulation, spanning oversight and surveillance, supervision and regulation, and market integrity and investor protection. Reshaping the Financial Regulatory System: Long Awaited, Now Crucial makes the case that a thoughtfully reconfigured regulatory system is a necessary step toward effective regulation and the long-term stability of the financial system.

In a follow-up report, Unfinished Business: Banking in the Shadows, the Volcker Alliance identified new areas of vulnerability in the “complex and transforming ‘shadow banking’ system” that posed a high level of risk to the public and warranted greater attention by policymakers. Topics covered included the risk of runs associated with excessive reliance on short-term debt; the growing concentration of credit risk in a small number of highly interconnected clearinghouses for over-the-counter derivatives; and the fragmented and disjointed framework for regulating financial institutions in the United States.

The Financial Regulatory Initiative continued Mr. Volcker’s legacy of identifying systemic risks in the financial markets and introducing reforms to maintain the stability of the financial system for the benefit of the public. In testimony before the US House Committee on Financial Services in June 2019, Gaurav Vasisht, who served as the Volcker Alliance’s Senior Vice President and Director, Financial Regulation Initiatives from 2014 to 2020, warned Congress of the systemic implications of leveraged lending, noting: “the basic mechanics of leveraged lending… [are] in many ways reminiscent of the funding structures of pre-crisis subprime mortgages.”

The absence of Mr. Volcker’s passionate and influential voice after his death in December 2019 led the Volcker Alliance to conclude the work of its Financial Regulation Initiative.