Retirement Experts to New Government Employees: Think for Yourself

This article was originally published Februrary 23, 2018 by Governing.

When politicians talk about pensions, it’s usually about the enormous weight they place on government budgets. According to the Volcker Alliance, where we are consultants, state and local governments are on the hook for $1 trillion in unfunded pension liabilities. Lawmakers on both sides of the aisle push for pension “reform,” a word often used in a positive sense, to rescue dollars that could instead be used for other services. But what about future retirees? Is pension reform positive for them? In many cases, not so much.

Since the Great Recession, every state except Idaho has made changes to the pension benefits they offer public employees, according to Luke Martel, director of the employment, labor and retirement program at the National Conference of State Legislatures.

States have chipped away at pension benefits in many different ways -- eliminating cost-of-living increases, reducing employer and hiking employee contributions, and raising the retirement age, to name a few. But because of long-standing contracts, employees who are already on the payroll when reform takes place are spared most of the cuts. It’s new employees who bear the biggest financial burden.

“A lot of plans have become a lot less generous,” says Richard Johnson, director of the Urban Institute’s retirement policy program. “New hires may be lulled into a false sense that they are getting enough to tide them over when they retire, and often this might not be the case.”

According to a 2014 study of 24 states, pension reform has dropped new employees’ average expected retirement amount by 7.5 percent. The impact varies tremendously, but pension reform has been particularly extreme in some states: Expected retirement benefits are 20 percent less in Alabama and Pennsylvania, and 18.5 percent lower in Maryland.

To reduce their pension costs, almost half the states (19) have developed retirement plans that are a hybrid of defined-benefit (DB) plans, in which employees are guaranteed an employer-funded pension based on their salary and years worked, and defined-contribution (DC) plans, in which employees and employers pay toward their retirement. But half of those states (9) give employees the option of choosing a DC plan instead of a DB or hybrid plan. (That could be desirable for people who don't plan on staying in the public sector long because defined-contribution plans are portable from one employer to the next.)

Up until this year, the nine states with options had all automatically enrolled new employees in the DB or hybrid plan. But starting this year, new state employees in Florida and new teachers in Michigan will now be automatically placed in the state’s investment plan that is similar to a 401(k).

“Previously, you defaulted into the defined-benefit pension plan,” says Keith Brainard, research director for the National Association of State Retirement Administrators (NASRA). “Michigan and Florida switched, and the default is now the defined-contribution plan.”

But in both Florida and Michigan, new employees still have the option of making a conscious choice to be covered by the states’ traditional retirement plan. Most, however, will likely accept the choice the state makes for them.

“It’s hard for a young employee to think about something that’s 40 years down the road, but they shouldn’t assume that the default is the best choice for them. It’s worth it to do a little homework and research,” says Matthew Strom, vice president and actuary of the Segal Group in Chicago, which works with state and local governments to design and manage retirement systems.

Despite their push for pension reform, states don’t want to leave their employees hanging.

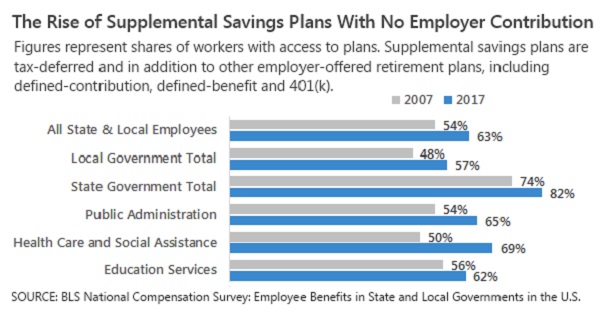

Many, including Ohio, have established supplemental tax-deferred accounts to help employees save for retirement. These are in addition to the retirement plan offered by the state. According to the Bureau of Labor Statistics, 63 percent of state and local employees had access to these supplemental accounts in 2017 -- up from 54 percent in 2007.

“There is a greater need for supplemental savings because of pension reform, and [states] recognize that,” says Keith Overly, executive director of the Ohio Deferred Compensation Program and president of the National Association of Defined Contribution Administrators.

To increase the likelihood that employees will save, Ohio started auto-enrolling them in the supplemental savings program in 2013, forcing them to opt out rather than in. This simple change has contributed to a dramatic increase in participation -- from about 10,000 employees in 2013 to about 32,000 in 2017, according to Ohio data.

Overly believes strongly in the need for supplemental savings: “With or without pension reform, I don’t think there’s been adequate savings for retirement.”