Truth and Integrity in State Budgeting - What is the Reality?

Preface

THE NATION’S STATES AND LOCALITIES spend more than $3.4 trillion a year, equivalent to more than a fifth of the entire US gross domestic product. The purposes and manner in which public funds are spent are matters basic to our well-being as a nation—education, health care, public safety; they all demand our attention.

These spending decisions are appropriate and necessary issues for political debate and decision. The Great Recession and the relatively slow growth of the US economy in recent years have intensified budgetary pressures in many states. Faced with constitutional, statutory, or customary requirements for annually balanced budgets, a large number of states have been forced to reduce or reallocate spending. The potential to defer or obfuscate in making these adjustments is very real. That is why the need for comprehensive and accurate accounting and transparent reporting of the financial positions of individual states is even more compelling.

To emphasize the importance of clear and comprehensible budgets to inform citizens, promote responsible policymaking, and improve fiscal stability, the Volcker Alliance commenced a study in 2016 of the budgetary and financial reporting practices of all fifty states, our largest project since our founding in 2013.2 The mission of the Volcker Alliance is to improve the effectiveness of the administration of government at all levels, and making processes such as state budgeting more transparent is important to that goal.

Critical to this work has been the cooperation of eleven universities, each with a demonstrably strong interest in public service education and particularly in the management of state and local governments. Faculty and students in the fields of public finance and budgeting have reviewed the budgets and financial reports of each state for fiscal 2015 through 2017 in terms of their timeliness, comprehensiveness, transparency, and willingness to fund current expenditures with recurring sources of revenue rather than one-time infusions. The universities’ research efforts were augmented by Volcker Alliance staff and data consultants at Municipal Market Analytics, an independent research firm based in Concord, Massachusetts.

A better-informed public should provide decision makers with incentives for transparency and accuracy in setting out spending and revenue reporting. By pursuing this investigation, the Volcker Alliance hopes that drawing attention to prevailing practices—and identifying the strongest and weakest among them—will encourage new efforts to raise standards for all states.

The Alliance also hopes to assist schools of public policy and administration by helping to widen the scope of research in the areas of public budgeting and finance while training students looking toward careers in state and local governments. The possibility of working with additional universities will be considered in the light of the perceived value of this initial effort.

PAUL A. VOLCKER

Foreword

AS BEFITS A FEDERAL SYSTEM composed of sovereign members, each US state has a unique approach to the way it raises funds and allocates expenditures for daily operations and capital investments. That is why it is of paramount importance to define the best practices in creating a balanced budget and to establish a methodology for assessing and comparing the quality of states’ budgetary building blocks against this common standard.

In this report covering all fifty states over the fiscal years of 2015 through 2017, the Volcker Alliance focuses on five critical areas that explain methods used to achieve budgetary balance, as well as how budgets and other financial information are disclosed to the public. States were given grades of A to D-minus for their procedures in:

- estimating revenues and expenditures;

- using one-time actions to balance budgets;

- adequately funding their public worker retirement and other postemployment benefits;

- overseeing and using rainy day funds and other fiscal reserves;

- and disclosing budget and related financial information.

In addition to assigning grades, the Volcker Alliance proposes a set of best budgeting practices for policymakers to follow.

Introduction

EVEN THE NATION’S THIRD-LONGEST economic recovery since 1858 has not been powerful enough to ward off fiscal crises for many states. Weak revenue growth is making it ever harder for states to pay the bills being run up for neglected infrastructure, education, and public worker pensions and retiree health care, among other obligations. These unpaid bills almost certainly exceed the $2.2 trillion in states’ annual revenues,4 and states may opt for pushing such debts to future generations in order to keep their annual or biennial budgets balanced in accordance with constitutions, statutes, or traditions.

In the following report, which covers the fifty states over the fiscal years of 2015 through 2017, we build on the findings and research methodology used in Truth and Integrity in State Budgeting: Lessons from Three States, the Volcker Alliance’s 2015 study of fiscal practices in California, New Jersey, and Virginia. As in our previous report, our focus has been on five key areas, both because of the amount of funds involved and the prevalence of weak reporting practices and disclosure:

- procedures in developing and presenting annual (or in some instances biennial) budgets, including the extension of reliable revenue and spending estimates over periods beyond the annual budget;

- use of ad hoc, one-off adjustments of revenues and expenditures at the expense of future budgets;

- practices with respect to funding (or failure to fund) pensions and other post-employment benefits for public employees—quantitatively by far the most important area of this study for most states;

- provisions for, and responsible use and replenishment of, rainy day funds and other fiscal reserves;

- and comprehensiveness of disclosure of budgetary information, including tax expenditures and infrastructure replacement costs.

In each category, a state was given a grade ranging from A to D-minus. Although there are no “failed states,” the results, as might be expected, cover a wide spectrum, with especially excellent or weak performances scattered across the nation.

In addition to grades, this report also presents in the following chapter a list of best budgetary practices in each of the five categories. While there is much to learn from the relative successes or failures of individual states, from the position of fiscal impact and political sensitivity, one area stands out: Relatively few states can reasonably claim that their provision for funding pensions and other employee benefits meets reasonable accounting practices, and a substantial number of them fall far short.

Though forty-nine states require balanced budgets by constitution, statute, or tradition (Vermont is the lone inhabitant of the third camp),5 how revenues and expenditures are mixed and matched can vary widely from state to state and year to year. Moreover, maneuvers used to create balance may disguise structural gaps between revenues and expenditures that will reappear in coming years.

The requirement for balanced state budgets generally refers to ensuring that the annual operating—or general fund—budget does not exceed estimated annual revenue. The general fund covers appropriations for state operating expenses, which generally include K-12 and higher education; health and human services; corrections; public safety; transportation; environmental protection and services; economic development; and support of local government. Funding for public employee pension and postretirement health care benefits may also be included in operating expenses. The general fund may be financed by personal and corporate income, sales, and estate taxes; levies on property; legal judgments; fees; and—as the report finds—one-time revenue sources, including debt proceeds and transfers from other state funds. The general fund does not typically include federal grants; tuition at state colleges and universities; or special-purpose levies, such as motor fuel taxes earmarked for highways.

Some budgetary expenditures may be wholly or largely discretionary, such as those for the salaries and expenses of economic development and environmental protection departments. Other budgeted annual operating expenditures may be mandated by prior contracts, statutes, or state constitutional requirements. These can include labor contracts; commitments to repay borrowed funds and associated interest; and payments required by court settlements, citizen-mandated referendums, or state-adopted legislation.

The importance of transparent, sustainable budgetary practices is only heightened by the failure of revenues to rebound in the current recovery to the long-term growth trend. According to the National Association of State Budget Officers, thirty-five states revised their revenue forecast downward by an average of 2 percent in fiscal 2017.

Slow revenue growth, even in the face of a steadily rising economy, is forcing many states to reexamine how they will cope with the increasing share of their budgets consumed by services that are expanding faster than GDP, including Medicaid and, frequently, public employee retirement and health care. To balance their budgets, states must increase taxes or hold down the growth of spending—or cut spending outright in discretionary areas such as education and infrastructure. Illinois and Kansas’s recent rollback of some income tax reductions and moves by twenty-six other states since 2013 to raise or reform gasoline levies reflect the challenges policymakers must confront.

The fiscal pressure is not likely to disappear anytime soon. The Volcker Alliance’s mission in grading states is to highlight those with practices that should be followed nationwide as much as it is to criticize those that fall short. The sheer magnitude of state and local spending—and the fact that much of the local portion comes from state budget appropriations—makes it essential that such expenditures are as transparent as possible, funded responsibly, and not left for future generations to shoulder.

Conclusion

HOW SHOULD STATES USE THIS REPORT, as well as planned future editions, as a guide? In each of the five areas covered in this report—budget forecasting, budget maneuvers, legacy costs, reserve funds, and transparency—public finance and budgeting experts at eleven schools of public administration and policy have identified a wide array of budgeting practices. The grades in each of these areas reflect the fact that while some states follow a broad range of best practices identified by the Volcker Alliance, others fall far short of their peers.

Nineteen states, for example, face challenges meeting their formidable legacy costs: the expense of paying not only for current workers’ promised retirement benefits but for promises made in past years that were never fully funded. Faced with almost $2 trillion in such unfunded obligations—on top of rapidly rising Medicaid expenditures and slow revenue growth—it is little wonder that 80 percent of states relied on one-time maneuvers during at least one of the years covered to keep their budgets balanced. It is also unsurprising that many states have limited investments in public education and infrastructure to achieve short-term budgetary balance, even though that will inevitably result in future generations’ compensating for the deferred spending. (The municipal bond market, the main vehicle for funding roads, bridges, and schools, has shrunk steadily since 2010,10 and net new municipal issuance is projected to stagnate until at least 2021.)

In the absence of a single constitutional or legislative definition of budgetary balance or how it should be achieved, the Volcker Alliance can point to these best practices—reflected in our state grades—that should be followed so that policymakers can craft more sustainable and transparent fiscal policies:

Best Practices in Budget Forecasting

States should use a consensus approach to establishing single, binding numbers for revenues and expenditures. In this way, they can avoid producing budgets predicated on a variety of different estimates— one from the legislature, for example, and another from the governor’s office. Washington stands out in this regard, getting top grades for fiscal 2015 through 2017.

The state relies on its Economic and Revenue Forecast Council, which includes representatives of the legislative and executive branches, as well as the state treasurer. Four times a year, the organization adopts a bipartisan revenue review, which is then used to build Washington’s operating budget.

States should also provide a reasonable rationale for forecasts and produce multiyear forecasts of revenues and expenditures. Multiyear estimates can help policymakers see whether states are creating future structural budget deficits.

Best Practices in State Accounting

The key to high grades in the Volcker Alliance evaluation of budget maneuvers is straightforward: States should pay for expenditures in the same year they are accrued and avoid deferring them into the future.

Cash-based accounting, the common practice for state and local government budgets, allows expenditures to be recognized only when payment checks have been written. But shifting to modified accrual accounting techniques that are already widely used in state and local comprehensive annual financial reports (CAFRs) would more accurately depict governments’ financial health. After its brush with bankruptcy in 1975, New York City was legally required to use generally accepted accounting principles (GAAP) for budgeting. It remains the only major US government to do so and has avoided fiscal crises in the four decades since it was forced to adopt its current system.

In the absence of GAAP budgeting, other types of maneuvers should be shunned as well. Delaware and Georgia, for example, were among fifteen states in 2017 that substantially avoided practices such as using proceeds of borrowing, municipal bond coupon premiums, or other up-front cash flows at the time of refinancing to pay for recurring expenditures, or making transfers into the general fund from special funds to pay for current expenditures. In addition, states should avoid temporarily pushing costs down to local governments—or “upstreaming” revenues intended for municipalities—as a temporary budget solution.

Best Practices in Funding Legacy Costs

This is by far the biggest challenge. States should consistently make the contributions that actuaries determine to be necessary. Wisconsin was among the leaders in this area, with pension liabilities that were almost fully funded. We acknowledge that some states may find it a crippling burden to pay for retirement benefits promised to current employees as well as restore past underfunding. But states with substantially underfunded pensions should consider committing to move toward full funding in the future.

For states that provide significant health care benefits to retirees—known as other postemployment benefits, or OPEB—it’s important to fund plans to make sure the benefits can be paid when bills come due. Utah stands out as a state with a successful path to fulfilling this objective. The state has two OPEB plans, one for state employees and one for elected officials. Actuarial valuations are calculated every two years, with the last valuation using data as of December 31, 2014, and the state providing sufficient monies to fully fund those plans for fiscal 2016.

Best Practices for Fiscal Reserve Funds

States should enact clear policies for withdrawals from rainy day and other fiscal reserves, as well as rules for replenishing spent funds and tying the size of fund balances to revenue volatility. Indiana was one of the states that earned top grades for fiscal 2015 through 2017. In 1982, the General Assembly adopted legislation calling for a rainy day fund administered by the state treasurer. The fund is run with clear guidelines for both the use and replenishment of assets.

Best Practices for Transparency

Legislators, advocacy groups, executive branch officials, and citizens are at a huge disadvantage if it is extremely difficult, or even impossible, for them to dig out the data they need to thoroughly understand a state’s budgeting practices, tax expenditures, and infrastructure replacement and debt service costs. One of the most useful devices in providing this kind of transparency is a consolidated budget website.

Although all but four states have such sites, Colorado’s is noteworthy. The state’s consolidated site of the Office of State Planning and Budgeting includes all budget information, including the budget request overview; budget documents and instructions; executive branch supplemental and stand-alone budget amendments; budget forms and templates; fact sheets; archives; and information from past years. Ideally, budget websites should also include full disclosure of the cost of replacing depreciated infrastructure.

These best practices for state budgeting cannot successfully contribute to fiscal stability and informed policymaking without the political will to adopt and apply them consistently for the long term. But the magnitude of states’ role in the US economy demands nothing less. Supreme Court Justice Louis Brandeis’s depiction of states as “laboratories” of democracy could not be more fitting for a study of budgeting practices in the fifty individual entities that make up America. Establishing and maintaining strong and transparent budget processes and practices is a concern not only for the states themselves but for the entire economy.

Areas of Analysis

Budget Forecasting

Budgets are planning documents that should paint a picture of a state’s fiscal outlook for the coming year or two (thirty-one states have annual budgets, with the remaining nineteen on biennial cycles).12 Whether enacted annually or every other year, budgets should ensure that state governments maintain a balance between the amount coming into the general fund and the amount going out.

Central to that mission is developing and maintaining the capacity to forecast revenues and expenditures in the coming year or biennium and, ideally, for multiple future years. When forecasts are inaccurate, states may be forced to cut spending or increase taxes unexpectedly or to resort to one-time actions to return the budget to balance.

Forecasting often refers to revenues exclusively, but estimating the spending part of the equation is also critical. For example, understanding the affordability of tax cuts, without depending on borrowing or one-time revenues to finance them, is contingent on the state’s ability to estimate and control expenditures. Equally important is being able to estimate the impact of changes in the nation’s economy on state finances. Following the end of federal recovery aid to states after the Great Recession, many budgets were hit in 2011 and 2012 with unanticipated sharp jumps in spending on Medicaid, the federal-state health care program for lower-income Americans.

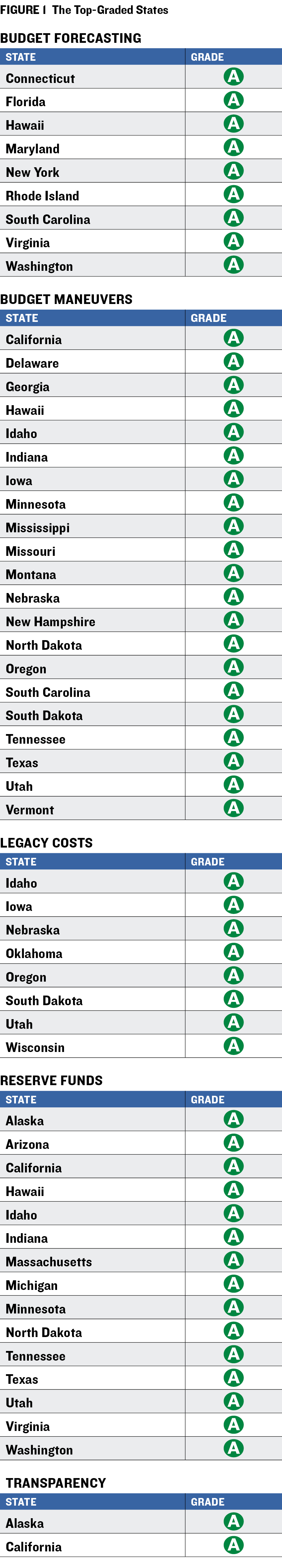

With these considerations in mind, the Volcker Alliance sought answers to a series of questions about the ways states estimate future revenues and expenditures. Based on average performance for fiscal 2015, 2016, and 2017, just nine states received the highest possible grade of A in this category: Connecticut, Florida, Hawaii, Maryland, New York, Rhode Island, South Carolina, Virginia, and Washington.

These are the five questions Alliance researchers posed on budget forecasting:

- Does the state utilize a consensus revenue estimate for the forthcoming fiscal year or biennium in budget and planning documents? Consensus revenue forecasts are made by a group of contributors, often involving the legislature, executive branch, economists, and representatives of the Democratic and Republican parties. The point of a consensus forecast is to make it easier for policymakers to concentrate on expenditures instead of arguing about whether the revenue estimate was politically driven. While consensus revenue forecasts are not necessarily more accurate than ones produced by a governor’s budget office, the process is likely to go more smoothly when all the parties involved in forming a budget agree on a single revenue figure.

- Does the state provide a reasonable, detailed rationale to support revenue growth projections at the time of the initial budget? Particularly when there is no consensus method for predicting revenue growth, estimates for future years can be frustratingly opaque. For instance, Georgia’s budget revenue estimate is accompanied by little discussion of the assumptions and methodology used to produce it.

- Did the state successfully avoid having to make a material midyear negative budget adjustment? As the year progresses, expenditures can often exceed revenues and necessitate a midyear budget adjustment, often in the form of spending cuts. Not adjusting the budget to reflect fiscal realities would be a mistake, of course, but whether a state did or did not make such an adjustment is a good indicator of the accuracy of the initial forecasts.

- Does the state utilize multiyear revenue forecasts for at least three full fiscal years in budget and planning documents? Volcker Alliance researchers found that just over half of states provide long-term revenue forecasts. For example, despite fiscal stress that in 2017 left Connecticut’s governor and legislators unable for months to agree on a biennial budget, the state has maintained a firm eye on its long-term revenue outlook. The two-year budget that started on July 1, 2015, included projections for fiscal 2018, 2019, and 2020, with detail provided by fund and revenue source, along with the assumptions used to make the projections.

- Does the state utilize multiyear expenditure forecasts for at least three full fiscal years in budget and planning documents? Expenditure forecasts that extend for only a year may not reveal structural budget deficits that will need to be addressed in the future. For example, costs when social welfare programs are ramping up may be far lower in the first year than in future years. Awareness of future expenditures can help states take necessary steps to cover the full costs of such programs and keep one-time revenue solutions to a minimum.

In evaluating states’ forecasting policies, we looked especially for those that estimated revenues and expenditures well beyond the upcoming year. Florida, for one, discloses a revenue forecast for six years via budgetary documents filed by the Revenue Estimating Conference, which includes representatives of the governor, senate, house, and Office of Economic and Demographic Research. Additionally, the office provides detailed information on revenue projections for six years via the annual General Revenue Fund Financial Outlook Statement. It also discloses expenditure forecasts for six years, covering spending in areas such as criminal justice, education, self-insurance, and social services.

Another best practice is found in New York, which provides detailed explanations of anticipated changes in revenue. The state’s Economic and Revenue Outlook for fiscal 2017, prepared during the previous fiscal year, noted that 2016 state tax receipts were estimated to have expanded 5.7 percent for several reasons. They included strong growth from a low prior-year base that was influenced by changes in 2013 to federal tax law, an atypical number of large estate tax payments, and strong growth in real estate transfer levies. The analysis is useful in weighing the likelihood that projections of annual tax receipts for fiscal 2017 through 2020 will be accurate.

Rhode Island, which has confronted fiscal challenges for many years, still excels in painting a full picture of its budget drivers. The state presents long-term forecasts for both revenues and expenditures, and a five-year financial projection was presented as an appendix in the governor’s executive summary of the fiscal 2016 budget.

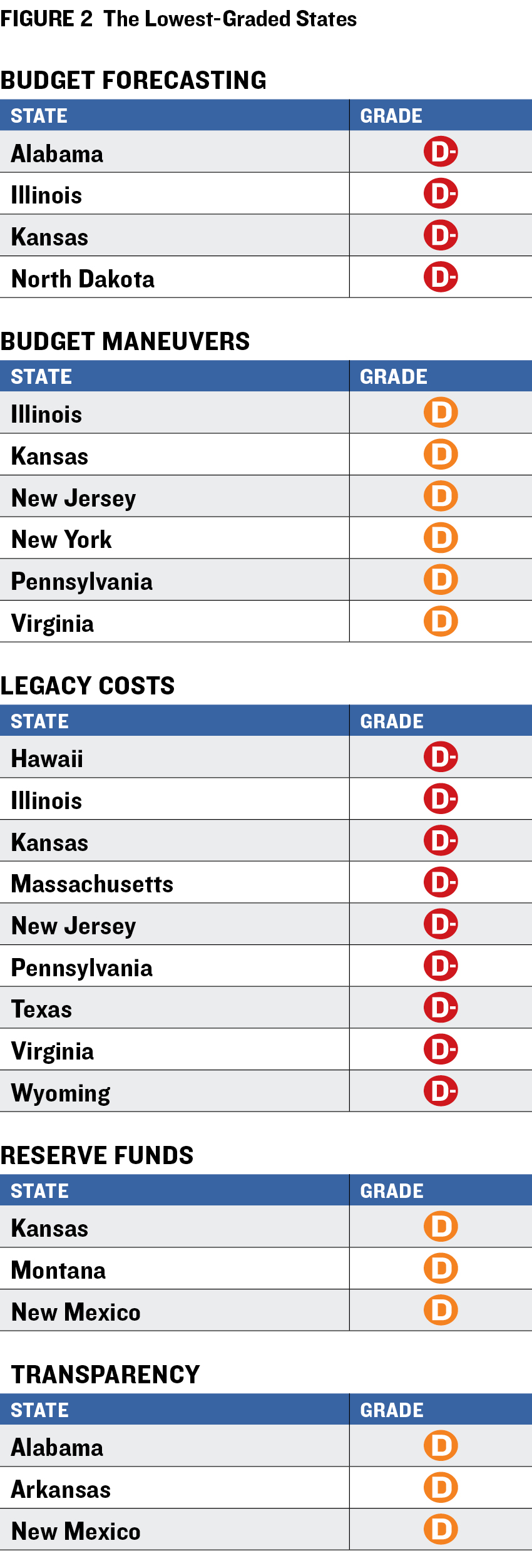

At the other end of the spectrum, four states garnered the lowest grade of D-minus: Alabama, Illinois, Kansas, and North Dakota.

Kansas was penalized for a lack of publicly disclosed revenue or expenditure estimates covering three years or more. Among states faring slightly less poorly was Missouri, which earned a D for failing to publicly project revenues beyond the coming budgetary year. Its legislature voted in 2014 to implement significant tax reductions beginning with taxes paid in 2018 if revenue growth reaches a specified threshold. Yet estimates of the cut’s long-term impact on revenues remained undisclosed in fiscal 2017 budget material as of October 31, 2016, the cutoff date for research on that year.

Budget Maneuvers

A basic tenet of budgeting is that one-time revenues should fund only one-time expenditures and that recurring revenues should cover obligations that come due every year. But it is a principle too frequently ignored over the normal ebb and flow of economic and budget cycles.

Instead of going toward funding budgetary reserves or capital expenditures, fiscal windfalls may be used to pay for services that would otherwise be unaffordable. When revenues lag, states may balance their budgets through one-time actions, such as pushing current expenses into future years, transferring cash from special funds into the general fund, or selling bonds to cover deficits.

One-time actions are encouraged by cash-based budget accounting, the practice followed by most state and local governments. In contrast, accrual budgeting recognizes transactions when an activity takes place, regardless of when it is paid for. A cash-based approach allows recognition of expenditures only when the checks have been written. As a result, if an expenditure is deferred into an out year, that cost is invisible in the current-year budget.

Building on the research and findings from 2011 through 2014 of the State Budget Crisis Task Force, chaired by Alliance Chairman Paul A. Volcker and Director Richard Ravitch, the 2015 Volcker Alliance report Truth and Integrity in State Budgeting: Lessons from Three States cited short-term measures facilitated by cash-based budgeting practices. It noted that financial conditions would be “more accurately depicted using the modified accrual accounting techniques already required for the governments’ comprehensive annual financial report.”

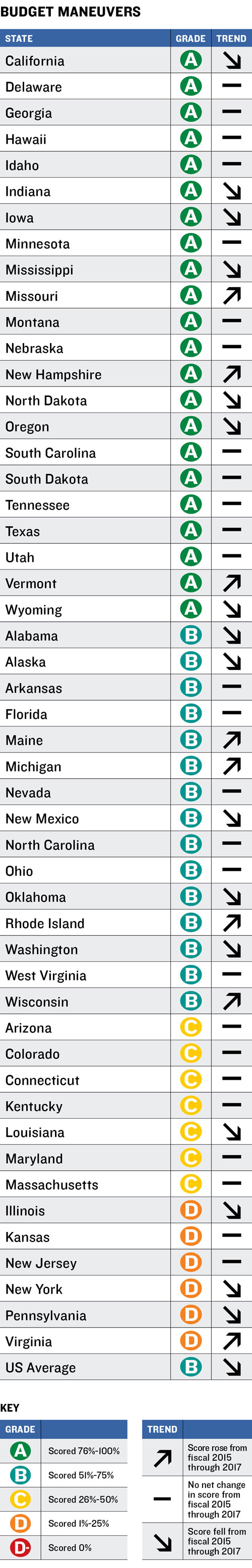

During the period the Volcker Alliance studied for this report—fiscal 2015 through October 2017—many states largely aligned the timing of revenues with expenditures. Twenty-two states received an average grade of A for their avoidance of budget maneuvers; another fifteen got a B, reflecting limited reliance on one-time actions to close budget gaps.

A handful of states with more severe budget stresses resorted to one-time measures. Alaska was one of them. While the 2016 budget adopted by the legislature appropriated $700 million from the general fund for refundable oil exploration expenditures, the governor vetoed $200 million of the total. These planned payments to oil and gas companies will be shifted to future years.

Using one-time revenue sources to cover ongoing expenses tends to be most common in times of economic or fiscal stress, when the practice becomes an alternative to raising taxes or cutting services. Volcker Alliance researchers found that twelve states graded C or lower for budget maneuvers over the three years studied were grappling with the need to pay for large, unfunded public employee pension liabilities—and were thus susceptible to taking one-time actions. Louisiana, for example, received an average grade of C for its dependence on one-time measures to balance budgets as its revenues slumped amid falling oil and natural gas prices, as well as a near-doubling of corporate tax exemptions. (The state had previously followed a best practice by putting one-time federal dollars received after Hurricane Katrina in 2005 into one-time spending to repair storm damage.)

Following are the nine questions researchers used to evaluate states’ use of one-time moves to balance budgets:

- Did the state successfully avoid using borrowing proceeds to pay for recurring expenditures? This query goes directly to the point that current-year revenues should pay for current-year operating expenditures. Using those borrowed funds to pay for current spending presents a mismatch. If revenues don’t steadily rise as unpaid bills from past years are finally paid, it becomes more difficult for a state to keep up. Connecticut, Virginia, and Illinois used one-time borrowings every year in the study period.

- Did the state successfully avoid utilizing so-called scoop-and-toss refinancing to raise funds for any current expenditures, including debt service? “Scoop and toss” refers to the process of repaying maturing bonds by selling new long-term debt, which generally extends the time line for paying off the obligation. In 2015, West Virginia issued $134 million in refunding bonds to help repay debt maturing that year and to reduce future debt service. The state accomplished that goal. Thanks to lower interest rates, it picked up $26 million in additional cash—just as individuals do when they refinance their homes at lower rates. However, West Virginia chose to use that extra cash over a few years rather than over the life of the new bonds, which would have been the preferred practice.

- Did the state successfully avoid diverting bond premiums (or other up-front cash flows generated during sales of bonds or other financial transactions) into the general fund or other general revenue account? Whatever daily municipal market interest rates may be, states often structure the debt they sell to finance infrastructure or other costs with standardized bond coupon yields of 5 percent, a provision preferred by investors. This means every $100 worth of bonds will pay interest of $5 annually. With long-term municipal interest rates under 5 percent during the three years of the Volcker Alliance study, investors paid extra up-front cash to receive those standardized coupon bonds. Ideally, the states would use that premium to fund the project at hand or reduce indebtedness. But instead, some use the extra money—the premium, in market terms—to pay for current-year operating expenses. This stretches the cost of the premium over the life of the bond, which generally will mature or be redeemed in ten to thirty years. Connecticut issued several rounds of refunding bonds in fiscal 2015, 2016, and 2017. In 2015, for example, the state relied on about $152 million of bond premiums to reduce its annual appropriations for debt service.28

- Did the state successfully avoid utilizing up-front proceeds or deferral of up-front costs on financial transactions to fund recurring expenditures? Some financial transactions may be structured to include cash payments from outside parties at the inception of the deal. The up-front proceeds can be used to close budget gaps, although such a move may leave less cash available for future budgets. Kansas, New Jersey, Pennsylvania, Virginia, and New York were found to have shifted proceeds or costs during the period of fiscal 2015 through 2017.

- Did the state successfully avoid utilizing pension bond proceeds to make the annual required or actuarially determined contribution to any pension? States may make their contributions to public employee retirement systems with cash from the general fund or with the proceeds of bonds sold for the purpose. If the state is skillful—or lucky—the return its pension fund earns on the borrowed money will exceed what it pays investors in interest. Often that does not work out. At the extreme, New Jersey sold close to $2.8 billion in pension bonds in 1997. The permanent interest rate was 7.65 percent—more than double the yield prevailing by fall 2017 on tax-exempt municipal debt maturing in twenty years. According to New Jersey Policy Perspective, a nonpartisan research organization, $2.3 billion is still owed on the $2.8 billion borrowed, with the long-term bill for the bond estimated at $10.3 billion. During the three-year span of this study, Kansas was the only state to issue pension bonds. In August of fiscal 2016 (which began July 1, 2015), the state sold a $1 billion bond at an interest rate of slightly under 5 percent.31 Proceeds of the issue were put toward the pension system’s unfunded liability. In the same year, Kansas also deferred $97 million in pension contributions.

- Did the state successfully avoid deferring recurring expenditures, excluding those for capital projects, from the current fiscal year to future fiscal year or years? Deferring payments into future years is the equivalent of buying a new car with no payments due in the first year but not being sure that you’ll be able to pay when the monthly bill for the vehicle starts appearing. Illinois has followed a variant of this strategy for years, allowing past-due bills to exceed $16 billion, plus interest, as of September 2017.

- Did the state successfully avoid utilizing one-time transfers into the general fund from special funds to pay for recurring expenditures? This is probably the most common one-time technique to balance budgets explored in this report. About thirty states tapped money intended for or transferred from a special fund. Generally separate from the general fund, special funds are dedicated to a select set of costs. Even transfers from the state’s rainy day fund can create instability. Taking cash from such a reserve to balance the budget may leave the state with another gap to fill some other year.

- Did the state successfully avoid utilizing proceeds from nonrecurring material asset sales (excluding routine disposal of surplus or outdated property) to fund recurring expenditures? Sometimes asset sales are regular events—say, selling used or surplus vehicles. But if larger assets such as property or income-generating authorities are sold, the proceeds should be used over a long period. Drawing on such funds to cover current expenditures presents a risk, as the assets have been sold but expenses can remain. Though states haven’t used this tactic widely over the past few years, $89 million from proceeds of the sale of the Leverett A. Saltonstall State Office Building in Boston were used to balance Massachusetts’s budget in 2015.

- Did the state successfully avoid temporarily shifting costs (to counties, municipalities, school districts, or other governments or agencies) or upstreaming cash from any such entity to the state, unless the action is part of a regular agreement or process? This question attempted to identify states that moved funds designated for one level of government to another. For example, in 2015, Arizona shifted to counties part of its commitment to pay for institutionalization costs for certain individuals. This was one of several adjustments of expenditures it made between levels of government that year.

Reserve Funds

Rainy day funds—sometimes called budget stabilization funds—are an essential tool to help states weather the ups and downs of the fiscal cycle. Like positive general fund balances at the beginning of each fiscal year, rainy day funds contain cash purposefully set aside to help states avoid or limit tax increases or service cuts in emergencies or in years when expenditures outstrip revenues.

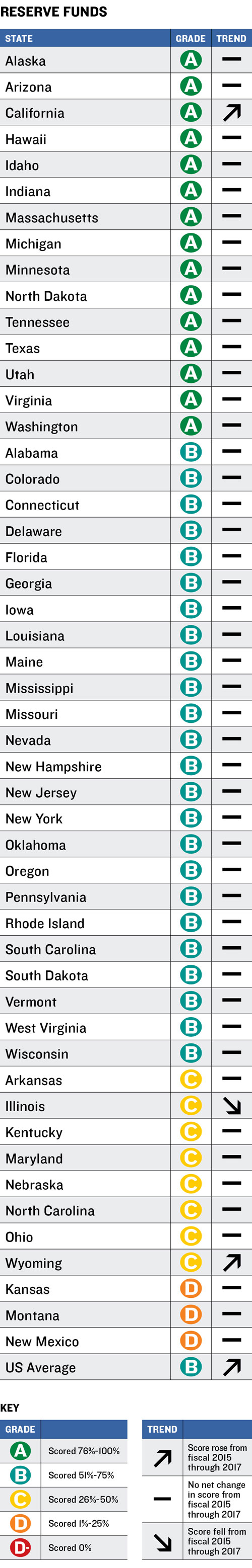

Based on their average performance in fiscal 2015, 2016, and 2017, only fifteen states got a top grade of A for their reserve fund policies and balances, while twenty-four earned a B. Kansas, Montana, and New Mexico received a D for the three years covered. Kansas passed legislation in May 2016 establishing a rainy day fund as of July 1, 201742; in fiscal 2017, the Legislative Budget Committee was directed to study the issue of how the state would provide funding for it in the future.

Fiscal reserves do more than protect states against recession. Governments also need to keep cash on hand to help cope with the revenue volatility that can be caused by natural disasters or drops in capital gains and with severance taxes caused by plunges in prices on financial and commodities markets.

Revenue volatility varies from state to state, according to a 2017 analysis by the Pew Charitable Trusts.44 Dependence on excise and severance taxes from the production of oil, gas, and other natural resources is one cause of volatility, while another is reliance on capital gains taxes—prevalent in states such as California, Connecticut, Oregon, and Vermont. Such reliance can cause revenues to fluctuate in tandem with the stock market, although California took steps in 2014 to ensure that a portion of capital gains is no longer considered ongoing revenue. Meanwhile, Vermont has a highly progressive tax structure and a relatively small population, which leaves its revenues at the mercy of changes in the earnings of a relatively small number of high-income residents.

Volatility is not a problem if a state manages it by putting away one-time surpluses for future use.48 In August 2017, for example, Houston and parts of East Texas were overwhelmed by Hurricane Harvey, which caused billions of dollars in damage. While the state will need federal resources to help pay for reconstruction, it will also benefit from having large cash reserves—a main reason for Texas’s A grade in this category. The Economic Stabilization Fund, the state’s rainy day account, is supported by natural resource taxes and had $9.7 billion as of June 30, 2016, the largest such reserve in any state, according to the Texas Comptroller of Public Accounts.

The existence of a rainy day fund isn’t enough to ensure that it will be available to use when necessary. It’s critical for states to have clear, transparent statutes or policies in place that govern how money can be withdrawn and replenished. States scoring lowest in the Volcker Alliance evaluations were more likely to allow rainy day funds to remain depleted after withdrawals. While New Mexico, for example, allocates assets to the rainy day fund as part of the annual budget process, it does not have the rules many other states do to ensure that dollars go into the account.50 As a result, the legislature can allow funding to languish if it has other priorities.

Questions posed by Volcker Alliance researchers for fiscal reserve policies included:

- Does the state have a policy (set by constitution, referendum, statute, or other formal rule) for the use of its rainy day funds? One of the most potent indicators that a state is setting aside money for future fiscal downturns is a clear set of policies that dictate how the fund should work. Michigan set up policies for its Counter-Cyclical Budget and Economic Stabilization Fund as a portion of the general fund in 1977—long before many other states had taken such steps. Some states may have policies on the books, but they may be ineffective. In Kentucky, the statute on use of the Budget Reserve Trust Fund provides guidelines for executive use but does not restrict legislative use. This limits the ability of state leaders to know with confidence that the reserve will be in place if required in an economic downturn.

- Does the state have a policy (set by constitution, referendum, statute, or other rule) for the replenishment of rainy day funds? States should commit to replenishing reserves after funds are withdrawn. North Carolina, for example, has a written goal obliging the state to set aside in the Savings Reserve Account a quarter of any unreserved balances remaining in the general fund at the end of each fiscal year. In addition, the state has a written goal that its rainy day fund will be equal to or greater than 8 percent of the prior year’s general fund operating budget.

- Is the state rainy day fund balance (or contribution) specifically tied to the historical trend of revenue volatility? In the 1980s, credit rating agencies suggested that states should hold 3 percent to 5 percent of revenues in reserves. A unique standard for each state based largely on revenue volatility may be more appropriate. Yet over half of the states did not appear to make any direct linkage between revenue volatility and rainy day fund balances.

- Was the state rainy day fund balance greater than zero on the first day of the fiscal year? Even a robust policy is no help if the fund is empty at the beginning of the fiscal year. We found that five states—Illinois, Kansas, Montana, New Jersey, and Nevada—had either no cash in their rainy day fund or no formal rainy day fund in operation in fiscal 2017.

- Was the state general fund balance greater than zero on the first day of the fiscal year? Policies governing rainy day funds make them a powerful tool for countercyclical budgeting. Having a general fund balance that is greater than zero on the first day of the fiscal year can also provide a buffer against revenue or expenditure surprises. Montana is one of only three states (along with Colorado and Illinois) lacking a separate and effective rainy day fund to manage unexpected shortfalls over multiple years, according to legislative testimony by Robert Zahradnik, principal officer at the Pew Charitable Trusts.56 But Montana keeps reserves on hand in the general fund. According to the state’s CAFR for fiscal 2016, the total balance of the general fund was reported at about $471 million on the first day of the year and had declined to $271.3 million by year’s end. The final balance was equivalent to about 14 percent of Montana’s $2 billion in general revenue in fiscal 2016.

Legacy Costs

Of all the troublesome fiscal issues confronting states in recent years, the one most threatening to budgetary stability is the more than $1 trillion in unfunded liabilities accumulated in state and local public employee pension systems (see figure 3), plus at least $600 billion in obligations for postretirement health care.36 Even with the stock market’s robust gains in 2016 and 2017 helping to bolster retirement plan funding—and thus taking some financial pressure off policymakers—any significant market retrenchment will inevitably lead to more funding woes. That is of special concern to states ranking low in the Volcker Alliance’s assessment of how governments are dealing with legacy costs when they attempt to balance their budgets.

State and local governments have traditionally viewed promises of pension and other retiree benefits as a way to attract and retain employees for the long haul. Yet in weighing the need to fully fund retirement costs against the need to maintain general fund spending on roads, schools, universities, and public safety, states may end up taking shortcuts to achieve budgetary balance. When they decide not to pay the full amount that pension actuaries deem necessary to fund the promised retirement costs of current workers, along with liabilities run up for past underfunding, states push those costs—plus interest—onto future generations.

States and localities sometimes sell bonds to fund retirement costs, betting that any returns earned on the borrowed money will exceed interest payments to investors. The way that state and municipal governments calculate future pension liabilities also can affect the level of funding they provide. The discount rates used to estimate the present value of future liabilities typically reflect the high returns of past decades instead of the lower rates and returns prevailing in recent years. While the discount rates are based on estimates provided by a state retirement system’s actuaries, the Governmental Accounting Standards Board (GASB) obliges public pension plans whose assets are not expected to cover benefit payments to use a different rate on some liabilities that may be lower than the projected long-term rate of return. In the case of OPEB, states often set aside only minimal sums against their long-term liabilities and fund annual expenses on a pay-as-you-go basis.

These practices are so widespread across America that only eight states (Iowa, Idaho, Nebraska, Oklahoma, Oregon, South Dakota, Utah, and Wisconsin) received average grades of A from the Volcker Alliance on their legacy cost practices for fiscal 2015 through 2017.

The overall legacy cost grades were composed of separate grades for the way states handled pension and OPEB liabilities. The grades states received for pensions reflect their willingness to provide funding in line with actuaries’ recommendations, as well as the magnitude of any unfunded liabilities. The grades for OPEB reflect the ability to meet long-term costs by maintaining adequate funding or by keeping these retiree benefits low enough to obviate the need for long-term funding. (To maintain comparability among states regarding legacy costs, the Volcker Alliance relied on the approaches recommended by the GASB, even though some states use alternative approaches.)

We found that at various points over the three years studied, about twenty states contributed less to pension systems than the amount the plans’ actuaries recommended. Among those not making the full contribution for all three years were Hawaii, Illinois, Massachusetts, and New Jersey (although New Jersey municipalities, unlike the state itself, are obliged to contribute the full amount). The impact on state budgets of pension underfunding is evident. Before passing a budget in July 2017, Illinois went without one for more than two years as the legislature and governor fought over taxes and a menu of spending priorities limited by $119 billion in pension debt (as of June 30, 2016) and past-due vendor bills. A casualty of the long stalemate was the state’s credit rating, which Moody’s Investors Service downgraded to Baa3—one level above junk in June 2017.

Three states earning an A in the Reserve Funds category received D-minus grades from the Volcker Alliance for their handling of legacy costs. Hawaii, Texas, and Virginia all failed to make their full actuarially determined pension and OPEB contributions in all three years of the study. Under legislation passed in 2012, however, Virginia is scheduled to start making full contributions to pensions by fiscal 2019. Hawaii, meanwhile, is scheduled to begin making its full annual required contribution for OPEB in the same year under a law passed in 2013.

Some states have managed to keep up with their retirement funding obligations. The Nebraska Public Employees Retirement Board, which administers the state’s retirement plan, uses a conservative funding formula that led it to put $44 million into the plan’s fund in fiscal 2016, even though Nebraska’s actuaries had determined that slightly less than $30 million would be sufficient.

Unfunded pension liabilities tell only part of the story of states’ legacy costs. Unfunded OPEB liabilities also weigh on many states. In 2015, about four of five state government units offered OPEB to most employees not eligible for coverage under Medicare. About 70 percent provided a variety of retiree health benefits to former employees 65 and over, although who qualifies differs by state.

As with pensions, the amount states needed to fund these plans depended on a wide variety of issues relating to employee eligibility, the benefits offered, and actuaries’ assumptions. However, the significant difference between pension and OPEB liabilities is that the latter are often not subject to the same legal protections as pensions. This may allow states to improve the funding of retiree health plans by tightening eligibility requirements, reducing benefits, or increasing employees’ premium contributions.

Following are the two primary questions upon which the Volcker Alliance based its legacy cost evaluations:

- Was the contribution to the public employee pension fund effectively 100 percent of the actuarially required or determined amount? We assessed states’ pension-related performance by looking at their current pension funding ratio—a way to express the relationship of plan assets to promised obligations—as well as whether they made their full (or close to it) actuarially determined contribution (ADC) or actuarially required contribution (ARC) that year. The ADC or ARC, sometimes used interchangeably, denotes an amount that a retirement system’s actuaries have determined will adequately fund promised benefits accruing to current employees in a given year, as well as the cost of amortizing unfunded liabilities from past years.41 In fiscal 2016, sixteen states failed to make their full or close to full payment.

- Was the contribution to public employee OPEB effectively 100 percent of the ADC or ARC? A state received complete credit for making full or close to full ADC or ARC payments. Some states provide employees with little or no retiree health benefits, in which case there is little need for regular funding. The Volcker Alliance considered the contribution effectively 100 percent if the unfunded portion of the ADC or ARC was less than both $50 million and 0.5 percent of the budget. Eighteen states failed to meet that standard for OPEB contributions in every fiscal year studied.

Transparency

More than revenues and operating expenditures must be disclosed to fully understand the risks to policy implementation and fiscal stability that states may face in future years. Also required are details on capital spending and debt, tax expenditures, and other elements. And while the Internet’s growing capacity to store and disseminate data has improved access to budget disclosure, only Alaska and California received average grades of A for transparency for fiscal 2015 through 2017—principally because of the way they spell out infrastructure replacement costs on top of other items. While thirty-six other states were graded B and only three received a D, states still have much to do to improve the quantity and quality of budget-related information available to policymakers and the public.

Consolidated websites containing an array of disclosures are perhaps the most important way a state can offer a full range of the data necessary to understand and interpret budgets. In Minnesota, which received an average mark of B, the site run by the Department of Management and Budget contains documents covering budget processes; current and previous budgets; the governor’s original budget recommendations; budget and economic forecasts; revenue and economic updates; debt; and other budget-related analyses.59 Minnesota’s clear, comprehensive explanations include the kind of context that is essential to making sense of budget documents.

Data consolidation needs to get better, however. In addition to the broad absence of disclosure of infrastructure replacement costs, many states lack a variety of other important tables and charts such as long-term revenue estimates or the costs of tax abatements.

Following are the four questions explored in this area:

- Does the state have a consolidated website or set of related sites that provide budgetary and supplemental data? Not that long ago, researchers in need of information about states were forced to resort to multiple phone calls, followed by requests for hard-copy documents. Though the Internet makes an ever-growing body of information about budgets and other important government documents a keystroke away, the quality of websites varies. As noted, Minnesota gives users a complete array of information pertaining to its budget, while Arkansas falls at the other end of the spectrum, offering only minimal explanatory information on its budget office page.60 The state’s budget is presented in the form of spreadsheets, and revenue forecasts lack detail.

- Does the state provide tables listing outstanding debt and debt-service costs, and provide information on any statutory debt limits? All fifty states provide this information, an indication of the centrality of debt and debt service costs to fiscal status. Debt service takes a significant share of general fund expenditures in some states. New Jersey paid about $4 billion in debt service in 2016,61 compared with $1.6 billion for prisons and other correction operations,62 but all states must carefully heed the volume of their borrowing and ability to sustain debt payments. The risks of failing to do so are reduced bond ratings, higher borrowing costs, and less money available for public services.63 (However, just one state, Arkansas, has defaulted on its debt since 1868.64)

- Is the estimated cost of the deferred infrastructure maintenance liability for all of the state’s capital assets disclosed in budget and planning documents? Only Alaska and California earned full credit in this area. While many states show accumulated depreciation on assets in their annual reports, the scope and method of calculating the data can differ from state to state. More importantly, most fail to provide replacement costs to keep roads, bridges, and buildings in good working order. The cost of producing condition assessments is only one of many obstacles that governments cite in not disclosing this information. Declaring a budget balanced while omitting the long-term costs of maintaining infrastructure is not unlike a failure to fund promised pensions. Unless a state ends up closing its roads and bridges, it eventually will be forced to come up with the money to maintain its assets.

- California discloses the estimated cost of deferred infrastructure maintenance in its budget documentation. The state also releases a five-year infrastructure plan annually that provides an extensive accounting of needs.65 In Alaska, the Legislative Finance Division, which provides budgetary analyses, summarizes the deferred maintenance by department in the division’s annual overview of the governor’s budget request. The estimated backlog of projects was about $1.8 billion at the time of the fiscal 2016 request. Although this is more information than most other states provide, the report points out that the costs should be considered approximations.

- Does the state provide an annual or biennial tax expenditure budget (or similar document) showing the cost of any tax exemptions, credits, or abatements? States provide hundreds of billions of dollars every year in tax exemptions, credits, and abatements—ranging from breaks on sales taxes to economic development incentives for corporations aimed at creating jobs and housing. These are broadly known as tax expenditures because they represent allocations of public resources.

As these tax expenditures encompass revenues that may be permanently forgone or postponed to future years, a well-run state should disclose their nature and value to help legislators, executive branch officials, and citizens gain a full picture of the budget. In 2015, GASB began requiring disclosure of some tax abatements (typically agreements with corporations meant to spur job and housing creation) in state and local CAFRs.67 But tax expenditures listed in budget documents encompass a wider range of breaks for individuals, corporations, and nonprofits.

About three-quarters of states provide this kind of information in budget documents or comptroller reports. Yet the quality and frequency of the reports vary—and about a quarter provided no tax expenditure disclosure in the three fiscal years studied.

In Georgia—which, like Minnesota, received an average of B for budget transparency—voluminous data about the costs of tax expenditures and abatements can be found in the annual Tax Expenditure Report. It is prepared for the governor’s office by the Fiscal Research Center of the Andrew Young School of Policy Studies at Georgia State University (one of the schools participating in the research network for this project). The expenditure report is required by law and is located on the Office of Planning and Budget’s website, along with other budget documents.

Appendix A: State Grade Table